In this article, you will learn:

- Why monitoring debt ratios and measures is important.

- How to analyze different debt ratios and measures to provide significant insight for your church.

- Recommended benchmarks for debt ratios and measures.

- How to use debt ratios and measures in conjunction with other financial indicators to gain insight on how they may be warning your church on impending changes in its financial condition.

Introduction

In the spring of 2020, many of us experienced a drastically changed world. Where streets and neighborhoods were normally bustling with cars hurrying to work and children racing toward the school bus, there suddenly was no activity. It was eerily silent. The world was in the middle of a pandemic and life had changed abruptly. So how did this happen?

In January, there had been news reports about the outbreak of an “infectious pneumonia” in China, but many of us didn’t think too much about it at the time. The coronavirus was half a world away and didn’t seem like it would impact life here in the United States. Had we failed to see the warning signs and were now forced to take extreme measures to prevent the loss of thousands?

While a global pandemic is a radical analogy, a church that ignores the warning signs and indicators in key debt ratios and measures may have to take extreme measures to ensure its survival.

This article is the third in a series on how effective financial indicators can give your church vital insight into its financial condition and trends. We previously looked at How to Get the Most Out of Your Financial Ratio Analysis and Analyzing Key Financial Indicators: Cash Flow Ratios. Now we’ll discuss how to analyze debt ratios and measures using information from the CapinCrouse Church Financial Health Index™ (Index).

Why Monitor Debt Ratios?

It is important for churches to monitor debt ratios and measurements because the lender will be monitoring them even if the church isn’t. Secondly, many debt covenants are based on the results of these ratios and measurements. Violating them will require your church to obtain a bank covenant waiver from your lender for the audited financial statements or risk having all debt (including the long-term portion) classified as current or having the loan called. This adds the potential of additional disclosers in the audited financial statements, including going concern issues and a qualified opinion. More importantly, violated covenants can cause a strained relationship between a church and its lender.

Analyzing results from the Index also allows you to compare the condition of your church’s debt to that of similarly sized peers. In addition to a current peer-to-peer comparison, it provides a trend analysis of your church’s results between years and comparison to benchmarks that indicate what level of financing is considered healthy for a church.

Another Key Factor in Your Analysis

It is important to consider other financial ratios and measures alongside debt ratios. It’s also prudent to consider projected future capital needs and the impact they would have on these ratios. For example, if your church needed a new roof at a cost of $500,000, you would need to consider this when looking at debt ratios and the impact pending expenditures will have on them.

It’s the same decision process a church uses when deciding to finance capital expenditures with more debt versus using cash reserves. It’s all interrelated.

Purpose of Debt Ratios and Measures in the Index

The debt ratios and measures in the Index provide a high-level assessment of the health of your church and how you are managing your financing obligations. These ratios do not include a loan-to-value (LTV) comparison of debt to property because the data inputs in the Index are from external financial statements, which typically carry property at historical cost, not current market value.

Additionally, the objective of the Index is to perform a high-level assessment of the health of a church year over year against peers and recommended benchmarks, not to underwrite loans.

What Types of Ratios and Measures Are Used in the Index?

The debt ratios and measures in this article may be categorized into two groups as follows:

- The amount of debt held by the church

- The church’s ability to pay its debt

As with any financial ratios, ultimately your leadership and board should adjust the level of debt or borrowing to one that is acceptable based on their comfort level, knowledge of the church’s circumstances, and experience.

Debt to Contributions without Donor Restrictions

This ratio looks at your church’s ability to pay debt and measures how many times debt is greater than annual contributions without donor restrictions. It is calculated as follows:

Total Debt

Total Contributions without Donor Restrictions

Lenders look at debt as funded by contributions without donor restrictions because those are the resources from which your church will be able to pay mandatory debt service payments. By looking at trends in various congregations, contributions without donor restrictions help the lender determine what debt load your church will be able to handle on top of other required expenditures (salaries, benefits, mission expenses, facility expenses, etc.).

The lower the number, the higher the contributions without donor restrictions versus the level of debt. In other words, a lower result indicates your church has more resources available to pay your debt. Based on our experience with church clients across the country, the lower this ratio is, the less strain debt will be on your church’s budget.

How to Analyze This Measure

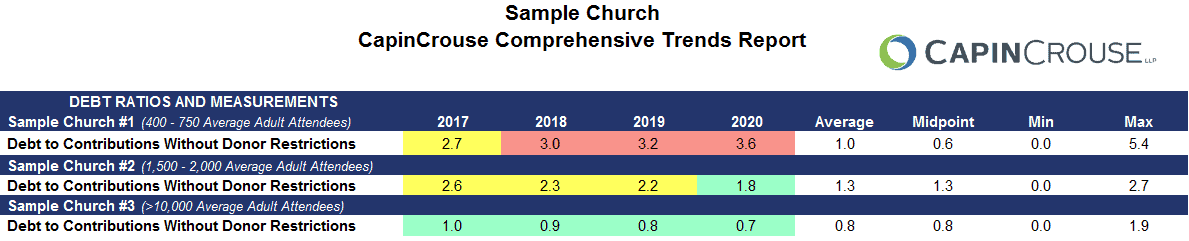

Let’s look at some sample ratios that have very different results and trends, and what this may indicate for each hypothetical church.

In 2017, Sample Church #1 was moderately outside of the recommended benchmark of 2.0 debt to contributions without donor restrictions. In 2018, they were significantly outside of the benchmark and continued to increase further after that. You can also see that the 2020 results are over triple the average and midpoint of peers. This indicates that the church’s debt levels are more than three times the support without donor restrictions, which places an excessive burden on the budget. It also means that debt is at a level lenders consider too great for the church to support.

In addition to the individual results of the church versus peers and the recommended benchmark, you can also look at the trend of the ratio between years. Sample Church #1’s trend is concerning because it shows that after 2017, their result increased and continued increasing above the benchmark each year. This indicates that the increase wasn’t caused by a one-time event—it’s the result of some other underlying cause that is continuing to affect this ratio. This could be due to several factors, including a continued increase in debt, a decrease in contributions without donor restrictions, or a decrease in attendees/giving units. Most likely, it’s a combination of all of these. Looking at the other debt and contribution ratios and attendee/giving unit numbers will help this church see what is driving this trend. Once they identify the key driver, they can develop operational plans to reverse the trend.

Sample Church #2’s results fall just outside the recommended benchmark. However, the trend shows a decrease to a result that is within the benchmark in 2020. This means the church is making a concerted effort to pay down debt or has successfully focused the congregation on giving more to allow them to pay down their debt. Again, it’s likely a combination of factors, and looking at the contribution ratios and attendee/giving unit numbers will pinpoint the reason for the change. This insight will help the church continue to improve this ratio.

Sample Church #2’s peer data shows that they are still above the average and midpoint of their peers, so they can conclude that there is still room to improve. However, the trend shows that they are making consistent progress. If the trend continues, the church will be in the range of peers.

Sample Church #3 is within the recommended benchmark and has continued to improve every year through 2020. The peer average is also below the benchmark. We can conclude that churches in this attendee range appear to carry a lower level of debt, so results below the benchmark are not unusual or unexpected.

Analyzing the trends, benchmark, and peer information of these ratios provides significant insight. And while it doesn’t answer every question you may have, it does tell you where to look next to figure out the underlying cause of your specific situation.

Mandatory Debt Service to Contributions without Donor Restrictions

This ratio also looks at your church’s ability to pay your debt and pertains more to the debt service (debt payment requirements), which is not an expense but rather a reduction of a liability. It computes the percentage of contributions without donor restrictions that will be necessary to make the annual debt service payments and is calculated as follows:

Required Annual Debt Principal and Interest (Including Capitalized Interest)

Total Contributions without Donor Restrictions

Interest and debt service payments can represent major resource outflows from the local church. Therefore, it is essential to continually monitor these levels as a percentage of contributions without donor restrictions that will be used to make the annual debt service payments. Although your church may have many revenue sources, lenders typically only consider contributions without donor restrictions when determining how much debt a church can handle.

A percentage too high would indicate that your church has an amount of debt service that requires immediate action to lower, as it is too high for your budget to easily support. Also, increases to variable interest rates could mean that a ratio at or above the benchmark does not allow much room in the budget to handle the additional payments.

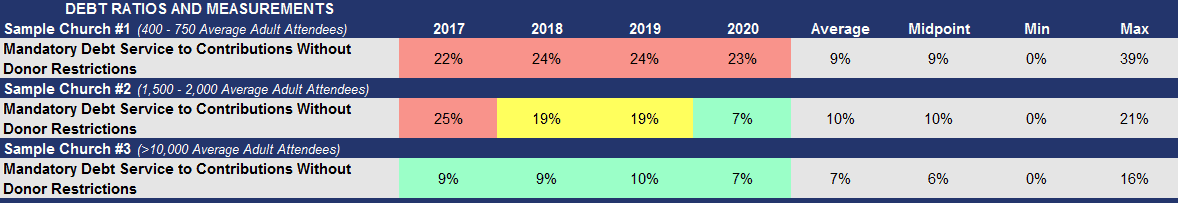

Let’s look at our sample churches again:

All of Sample Church #1’s results are significantly above the benchmark (less than 15% – 20%) and peers. They are using too much of their revenues to pay the annual debt service requirements and will need to pull resources away from other areas to make minimum payments, which is concerning. Their trend also shows that this church is consistently out of range and appearing to make no improvement, which places continual stress on the budget and pulls more resources from ministry.

Sample Church #2’s results were also substantially outside the benchmark and significantly above peers in 2017. Since then, the church has shown tremendous improvement and it is now within the benchmark and below peers. This shows a deliberate operational strategy that has resulted in either reduced debt service payments or increased contributions without donor restrictions, or both.

When they realized the strain debt service had on their budget, Sample Church #2 acted quickly to lower required annual debt service payments by restructuring their debt or focusing efforts on increasing giving, which allowed them to pay additional amounts contributed toward the overall debt and decrease interest expense. Either way, their decisive actions have had a dramatic effect, reducing stress on the church budget and freeing up more funds for ministry. The key will be whether this trend continues.

Sample Church #3 has maintained very healthy debt levels. Not only have their results improved, but they are even with the peer average. The results indicate that the church is easily able to handle their current level of debt service. The question for this church is not how they are going to make the minimum debt service payments but how they are going to invest resources for the future to support growth in their ministry, since the debt is not a huge burden on their budget.

See how different the questions are between the three churches? All are supported by ratio results.

Debt Per Average Adult Attendee and Giving Unit

This measure focuses on the amount of debt held by the church and is calculated as follows:

Total Debt

Average Adult Attendees and Giving Units

It introduces the concept of a giving unit. A giving unit is usually a group of family members who contribute jointly to the church. A giving unit is also defined as any recurring supporter of the ministry. This excludes the individual who may make a smaller one-time gift supporting an event, such as a short-term mission trip. To identify only the regular recurring giving units, the measure only includes giving units that contribute more than $250 annually to the church.

This figure is calculated by dividing total debt by the average number of adult attendees and giving units. It will vary significantly based on the philosophy, denomination, location, age, size, and demographics of the church.

Your church will need to determine the level of debt you are comfortable maintaining or servicing. You will probably encounter varying opinions within your congregation. Some individuals believe that a church should not incur debt while others are very comfortable with a high debt load. Lenders believe that debt will be funded by contributions without donor restrictions because typically these are the resources from which the church will be able to pay mandatory debt service payments.

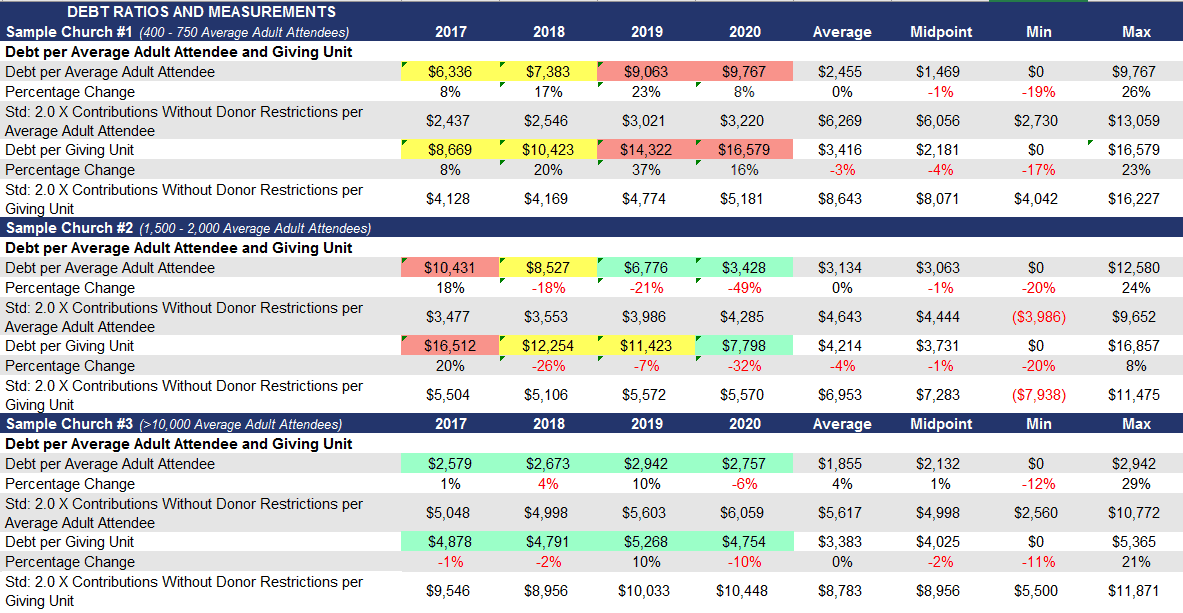

Let’s look at our sample churches again:

Sample Church #1’s results are concerning for several reasons. First, the trend is worsening and has gone from just outside of the benchmark in 2017 to significantly in excess of three times contributions without donor restrictions per adult attendee and giving unit, which is the top end of the range in the Index. Secondly, they are significantly above peers and are now carrying the highest debt of all peers in their attendee category. The increase is probably not because any lender is providing the church with additional debt but most likely because the contributions without donor restrictions and attendees or giving units are in significant decline. One look at the contribution ratios and attendee giving unit numbers will answer this question.

Either way, these results require immediate action by leadership as they indicate that the church’s debt levels are placing an excessive burden on the budget. It also means that debt is at a level the lender will consider too high for the average church attendee and giving unit to support. The church must immediately act to decrease total debt before it’s too late. This issue is urgent and making operational plans to address it must be the primary focus of the leadership and board. Otherwise, this church may not survive in the long run.

In contrast, Sample Church #2 is showing significant improvement in the trend of their measures. In 2017, they were also in excess of three times contributions without donor restrictions per adult attendee and giving unit. However, it appears their leadership took immediate action to implement a plan to reduce overall debt so that they were within the benchmark in 2020. Whatever changes they made have relieved significant stress from the church budget, to the point where they are now able to refocus efforts on ministry plans while the discussion of the debt measures has become more of a monitoring focus.

Sample Church #3 is well ahead of peers and consistently ahead of the recommended benchmark of 2.0 times contributions without donor restrictions per adult attendee and giving unit. This measure shows they are easily able to handle the level of debt they presently hold. Their results are ahead of the recommended Index benchmark of two times contributions without donor restrictions per adult attendee and giving unit. While they are above the peer average and midpoint of the range of peers, they are well within the recommended benchmarks of the Index. Based on our experience with church clients across the country, the lower this ratio is, the less strain debt will be on the church’s budget. It’s obvious they actively manage their debt level and while it continues to be monitored, it’s not likely the primary focus at board meetings.

Again, see how different the questions and discussions are between the three churches? All are supported by the results of these measures in the Index.

Debt Coverage

This ratio looks at your church’s ability to pay your debt. It is calculated as follows:

Change in Net Assets Without Donor Restrictions — Interest Expense — Depreciation Expense

Mandatory Debt Service Payments (Debt Principal + Interest)

This is a very common debt covenant ratio lenders use to monitor a church’s ability to make annual debt service payments. The results could change dramatically between years based on variations in net assets without donor restrictions. For example, if a church used its reserves to perform more repairs and maintenance to its facility than normal, the increase in expense could cause a much lower positive or even negative change in net assets without donor restrictions. This would adversely affect the ratio and could unexpectedly violate a debt covenant, potentially requiring the church to obtain a bank covenant waiver and pay related fees. The benchmark agreed to by the lender is a key negotiation point, especially with a new lender. It may also factor into the level of reserves the church leadership deems necessary.

The biggest factor impacting this ratio is significant increases or decreases to the change in net assets without donor restrictions. Ministry decisions or necessary additional expenditures as discussed above may drive the decision to spend net assets without donor restrictions and result in a lower positive or negative change in net assets without donor restrictions. While a lower positive or negative change in net assets without donor restrictions may impact this ratio in the current year, it is important to look at the trends and understand the reasons behind ministry decisions to spend resources without donor restrictions. It is equally important that the effect of these decisions on the ratio is not a last-minute surprise to management or your lender. An unexpected result could cause a strain on the relationship with the lender.

This ratio will tell the reader how many times a church would be able to cover its current annual debt obligations from current operations. We believe a reasonable benchmark for this ratio is a result greater than or equal to 1.15.

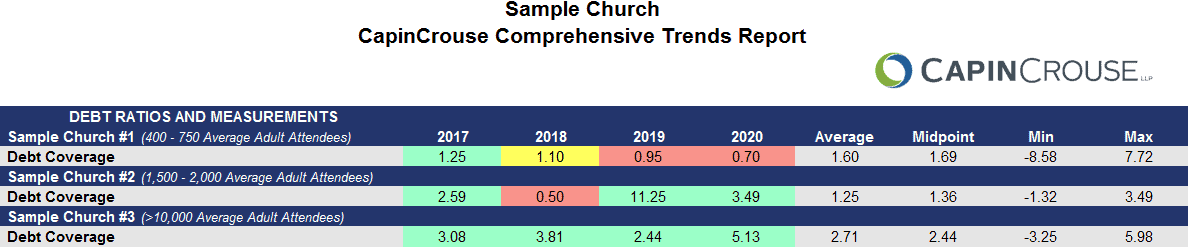

Let’s look at our sample churches again:

In Sample Church #1’s results, the main factor that stands out is the declining trend. While they started out above the recommended benchmark in 2017, the ratio has deteriorated significantly every year thereafter. This result requires immediate action because it indicates that annual debt obligations are too high to be covered by current operations (and have been for over a year). It’s also considerably below the peer average and places excessive burden and strain on the budget.

The biggest factor impacting this ratio is significant increases or decreases to the change in net assets without donor restrictions. Ministry decisions or unexpected additional expenditures may drive the spending of net assets without donor restrictions and result in lower positive or negative change. It’s critical to look at the trends, understand the reasons behind spending resources without donor restrictions, and immediately make spending changes.

Another factor that will impact this ratio is lowering the required annual debt principal and interest payments. This is usually done by modifying the terms of the debt with the lender, which may violate the debt covenant and require a bank covenant waiver. Either way, church leadership or the board must take immediate action to stop and reverse this trend.

Sample Church #2 is above both peers and the benchmark for three of the four years shown. Based on the result of their ratio, it appears that in 2018 the church decided to spend resources without donor restrictions, resulting in a low or negative change in net assets without donor restrictions. However, in 2019 they had a significant increase in net assets without donor restrictions. Perhaps in 2018 they incurred expenses for which a gift came in during the following year.

Whatever the reason, their positive ratio in the subsequent years shows us that the result in 2018 was based on a one-time decision that hopefully was made with the board’s agreement and communicated to the bank ahead of year-end so as to not create a problem with their debt covenants. We can assume that based on this trend, Sample Church #2 is carefully monitoring this ratio and making decisions ahead of spending.

Not only are Sample Church #3’s results consistently trending up and above the recommended benchmark, but they are also close to the maximum peer result in 2020. It appears they are monitoring this ratio carefully and making operating decisions that continue to strengthen it. Looking at contribution ratios and trends as well as expense ratios will support this conclusion.

If you know what to expect and can read the warnings, putting these analytics together can provide a comprehensive examination of your church’s debt. And that can be very valuable to your church leadership.

If you want to benchmark your church but are unsure where to start, ask us about the CapinCrouse Church Financial Health Index. This convenient online tool is designed to help churches measure and analyze their financial strengths, weaknesses, and trends to see where they have been and map the best route forward.