The IRS has just informed you of its intent to initiate an inquiry or examination of your church. What happens next? How do you navigate from here? In this webinar, we will walk you through the anatomy of an IRS examination. We will help you avoid the kinds of unpleasant experiences others have encountered in the process because they were not fully prepared.

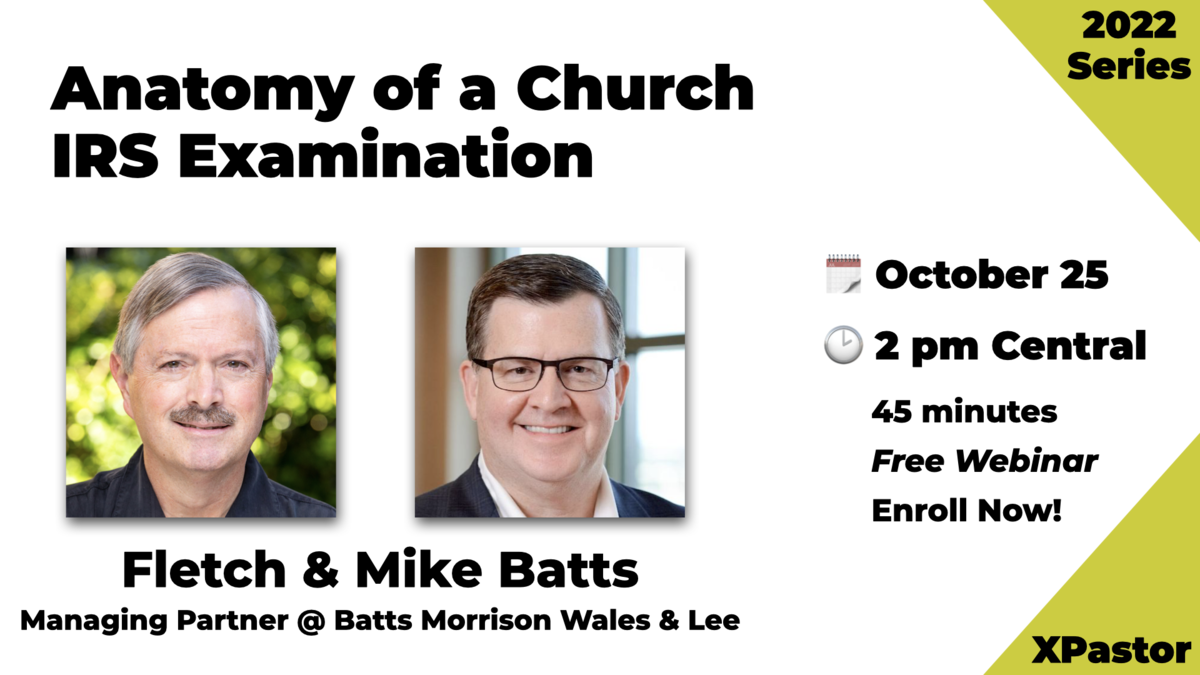

About Mike

Mike is the managing partner of Batts Morrison Wales & Lee. He has more than 30 years of experience serving nonprofit organizations in a variety of ways. Mike actively engages in nonprofit legislative matters at the federal and state levels. He has served on and chaired the boards of nonprofit organizations, both nationally and locally, such as the ECFA and the Commission on Accountability and Policy for Religious Organizations.

In 2013, Mike was inducted into the National Association of Church Business Administration Hall of Fame for his significant contributions to the church community. Mike is co-author of Church Finance, a go-to reference that provides practical guidance for church and nonprofit financial administration; and Nonprofit Financial Oversight—The Concise and Complete Guide for Boards and Finance Committees; and Board Member Orientation—The Concise and Complete Guide to Nonprofit Board Service.