Recent nonprofit financial reporting standards updates will result in several changes to external financial statements that church financial leaders should understand.

Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-14 is intended to improve information in nonprofits’ external financial statements and notes about financial performance, cash flows, liquidity, and availability. The ASU is in effect starting for churches and other nonprofits with a December 31, 2018 year-end audit, review, or compilation.

External financial statements are used to provide information to outside parties such as banks, church extension funds, and other lending institutions. Financial statements prepared under Generally Accepted Accounting Principles (GAAP) must include “footnote disclosures” that explain policies, background details, facts, or additional numerical summaries about totals in the statements. ASU 2016-14 includes the addition of specific liquidity disclosures to the footnotes of the external financial statements (we covered this in detail in Part 1 and Part 2 of our recent XPastor article series).

Church management and board members have consistently asked four questions about one of these changes, a new amount called “financial assets available to meet cash needs for general expenditures within one year” (I’ve shortened this to “financial assets available” in this article).

Even if they don’t ask, I include the answers to these questions in our church clients’ final audit or review exit presentation. It’s important for every church financial leader (including elders or board members, audit/finance committee members and senior management) to ask and understand the answers to these four key questions.

1. What are “financial assets available”?

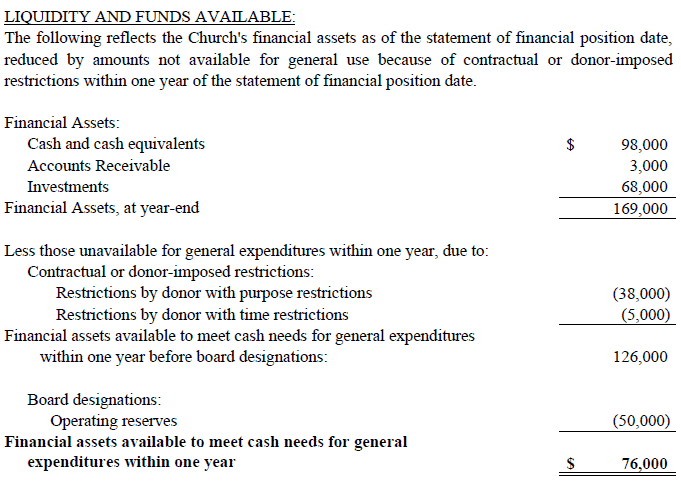

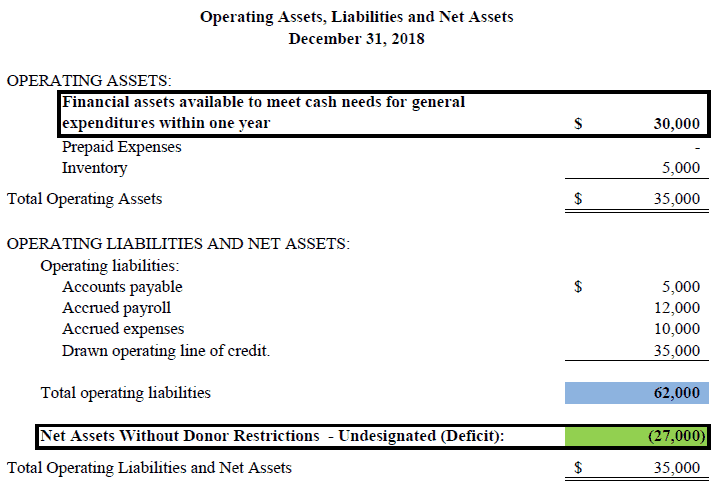

Here is a sample liquidity disclosure under ASU 2016-14 as it may appear in your church’s external financial statements:

The table ends with the total financial assets available. But what are they?

In most cases, especially for churches, financial assets available represent the undesignated operating cash of the church. Undesignated operating cash is the amount of cash available less unrestricted funds set aside by the board, and less funds held for donor-imposed restrictions. Essentially, they are resources available for your church to spend as needed in its day-to-day operations.

If your church does not have board-designated funds for operating reserves, this represents your operating reserves. If you do have board-designated funds for operating reserves, this amount needs to be added back to determine the church’s total operating reserves.

2. How do financial assets available relate to the unrestricted – undesignated net assets?

This is a very important question because the two amounts may not be not the same. This total does not replace unrestricted (now known as “without donor restrictions” under ASU 2016-14) – undesignated net assets (we’ve shortened this to “undesignated net assets” in this article). Over the years, I’ve emphasized how important it is for church boards to manage their undesignated net assets, and that has not changed. Undesignated net assets are the result of achieving positive change in net assets (known as “net income” in the for profit world) in the unrestricted (without donor restrictions) column of the statement of activities over the life of the church.

In business terms, this is the net income accumulated in retained earnings that result from earning money in the day-to-day operations of the church, so that the church has adequate cash flows to maintain its ministries. These accumulated earnings serve the same purpose, whether you call them “retained earnings” as in a for-profit entity or “undesignated net assets” as in a not-for-profit. They are reserves that will help fund the general operations of the church during the following year.

Undesignated net assets are key to the life of the church and must be closely monitored, especially when the church does not have adequate board-designated funds set aside for operating reserves. Many churches I work with set aside enough operating reserves to cover 8 to 12 or more weeks of operating expenditures.

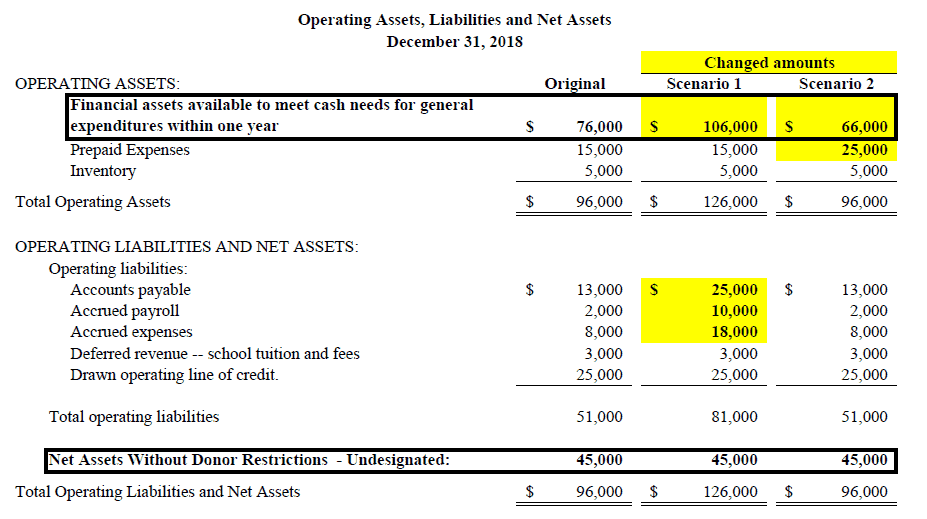

To demonstrate the difference between the two amounts (and how they relate), I provide the boards I work with a statement of Operating Assets, Liabilities and Net Assets during the exit conference (this statement is not part of the audited or reviewed financial statements because it only represents the operating portion of the church’s financial information).

Another way to look at this is to think of the external financial statement as a pizza. The statement of Operating Assets, Liabilities and Net Assets only represents one slice of the pizza, but it’s a very important slice. Let’s look at some examples:

In Scenario 1, the church increased its balances of accounts payable, accrued payroll, and accrued expenses, which had the effect of increasing operating liabilities. The offset was a corresponding increase to financial assets available. If you don’t pay accounts payable or other accrued expenses, you aren’t spending cash and operating cash increases.

In Scenario 2, the church prepaid several expenses—thereby increasing prepaid expenses—without considering the impact on their operating cash. By doing this, they lowered the financial assets available by the same amount that they increased prepaid expenses.

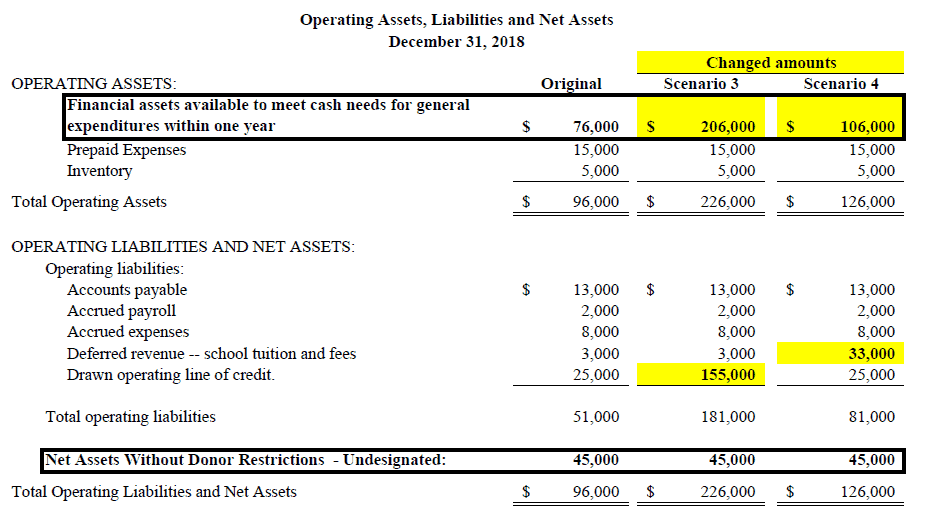

Now let’s look at a few more scenarios:

In Scenario 3, the church drew down an additional $130,000 on its operating line of credit (LOC), which increased operating liabilities and financial assets available. This also makes sense as a draw of cash on the LOC would provide additional operating cash (and also the corresponding liability).

In Scenario 4, the church’s school, which is part of the church’s financial statements, accelerated billings for the following fiscal year. This increased cash received and the corresponding deferred revenue liability. It would not have been a factor if the school was not part of the church’s financial statements.

Note that even though all these examples had the same net assets without donor restrictions — undesignated balance, each is reporting a different financial assets available amount.

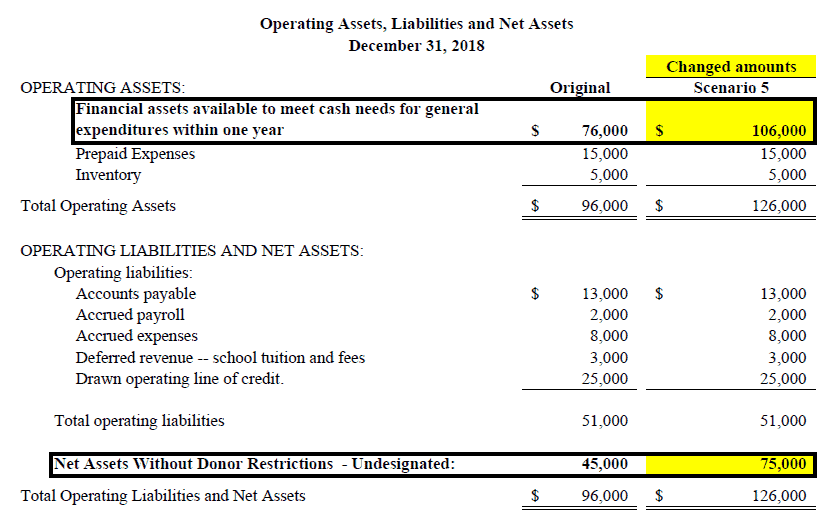

However, the most fiscally responsible way to increase this amount over the long term is as follows:

In Scenario 5, undesignated net assets increased because the church achieved positive net income in the unrestricted (without donor restrictions) column of the statement of activities. The resulting offset would be to increase financial assets available. So managing positive operations and increasing undesignated net assets would likely increase the financial assets available and help achieve long-term security for your church. As a financial leader, it’s your fiduciary responsibility to oversee the long-term economic health of your church. This scenario demonstrates a church that has fiscally sound practices and is achieving that goal.

The key concept to take away is this:

In Scenarios 1-4, the church had the same undesignated net assets (known as “retained earnings” in the for-profit world) or financial health of $45,000, which is the most important balance to monitor continuously. The financial assets available amount does help external financial statement readers see if the church is liquid and has undesignated funds available heading into the subsequent fiscal year. However, as the above scenarios show, the financial assets available amount cannot and should not be used to determine and monitor the church’s condition of financial health. As noted in the next question, this amount can be impacted easily by the church.

3. What impacts total financial assets available at fiscal year-end?

First, employ basic cash management strategies. If you can hold off spending money until after year-end, this will increase operating cash and cash equivalents. Consider the following areas:

- Accounts payable – If any significant invoices are not due until after the end of the fiscal year, wait and pay them after that date.

- Prepaid expenses – Similarly, don’t prepay any invoices. If the balance is not due until after the end of the fiscal year, wait and pay it then.

- Significant capital purchases or deferred maintenance costs – Consider delaying certain maintenance procedures until after the end of the fiscal year, if possible. (For example, it may not be prudent to delay repairs to a leaking roof as this could result in additional damage.)

- Inventory – If any significant inventory purchases can be postponed until after the end of the fiscal year, consider doing so. This will not be a key factor for many churches.

Second, look at your revenues. If your church is behind budget in unrestricted giving in the final quarter of its fiscal year-end, consider how you can communicate this to your congregation as an opportunity to catch up on giving.

Finally, if your church has a preschool, day care, or school that is part of your external financial statement, you could consider moving up the billing cycle. This will generate cash and increase deferred revenues as in Scenario 4 above. However, the decision to do this should be carefully considered as some might conclude accelerated billings are in effect debt or borrowing cash from constituents, which might not align with the mission of the school.

But what if your church has not set aside any board-designated operating reserves? If your church does not have an operating LOC, consider getting one. The qualitative disclosures in the new ASU requires the church to explain its backup liquidity plans for a low or negative amount of financial assets available by the following sample disclosure:

While the Church does not maintain large cash reserves without restrictions, the Church has an unsecured line of credit of $150,000 that it may draw on to meet its liquidity needs. This operating line of credit is tied to the Church’s main operating bank account via an auto borrow/auto repay feature and is drawn upon as needed. Cash availability is monitored closely by management and the Church board.

If your church has no other resources and does not have an operating LOC, you can choose to increase operating debt to fund operations. However, in most cases incurring this type of debt would be considered a red flag and is not recommended.

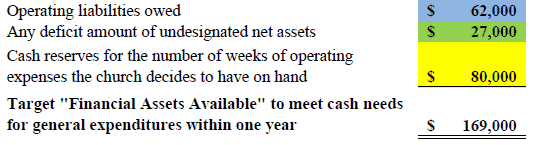

4. What should the total of my church’s financial assets available be?

This final question is probably the most important one church boards need to ask. Let’s look at another example:

Let’s assume that this church has $1,040,000 in annual expenses and the financial leaders have decided that they should have at least four weeks of expenses in reserves. The reserve needed would be $80,000 as shown in the chart below ($1,040,000/52 weeks X 4 weeks).

Using the financial information above, financial assets available should equal the sum of the following:

In the example above, the church has fallen short of the financial assets available target of $169,000 by about $140,000. The large amount of current operating liabilities tells us that this church may not be generating cash from operations, which must be corrected immediately. It has likely taken more than a year to develop the church’s operating deficit of $27,000. The first priority must be to stop the negative cash flow. This church must immediately start careful strategic planning and budgeting to erase the operating deficit and eliminate overspending. If the church can create unrestricted operating surpluses averaging about $15,000 annually, it will be able to eliminate the operating deficit in two years, and sooner if it can create a larger surplus. Erasing this operating deficit will go a long way to being able to improve the financial assets available total.

The CapinCrouse Church Financial Health IndexTM (Index) recommends a benchmark of 40 to 80 days’ worth of cash expenditures on hand and states in the benchmark that a result of less than 20 days could be interpreted as a red flag.

One final observation related to these four key questions: If a church follows the best practice of maintaining operating cash reserves of 40 to 80 days and maintains a realistic balanced budget each year, it will have the desired financial assets available and most (if not all) of the operational strategies in Question 3 will not be necessary.