Is a merger or acquisition right for your church? While there can be many benefits, a successful merger or acquisition requires more than just finding another church that feels like a natural fit.

Join us to learn the questions you should ask and the financial due diligence you should complete. We’ll discuss reasons to consider or decline a merger or acquisition and how to plan for implementation, perform a rigorous analysis, measure success, and more.

Learning objectives

- Describe how to approach a merger or acquisition logically and weigh the different options

- Explain key financial due diligence to perform, including evaluating financial information, searching for unrecorded liabilities, and addressing titles and taxes

- Identify questions to ask before entering a merger or acquisition

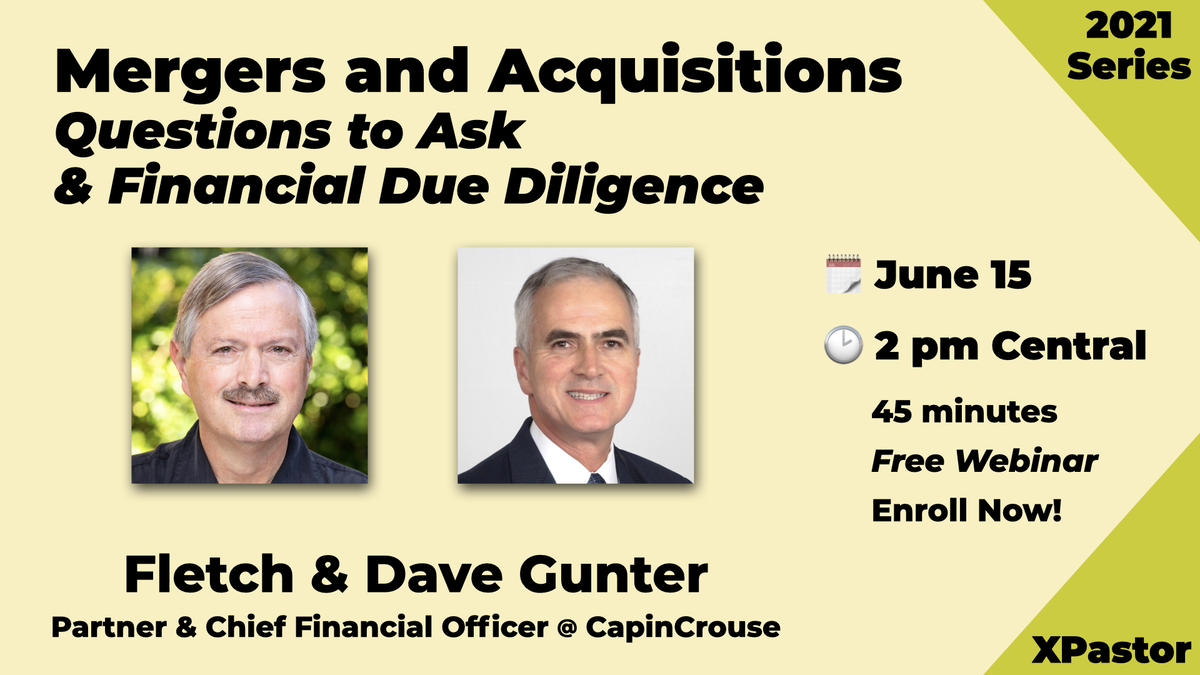

About Dave

Dave Gunter is Partner & Chief Financial Officer at CapinCrouse. Dave has 38 years of experience providing consulting and advisory services in business strategy, forecasting, revenue and donor analysis, cost structure management and operational efficiency, finance and accounting workforce planning and management, treasury and cash management, and interim finance, treasury, and accounting officer services. He has held chief financial officer, chief accounting officer, and treasury officer positions at publicly traded companies, and has extensive experience in SEC reporting, ratings agency issues, and operations and people management domestically and internationally. Dave has worked with numerous churches as a consultant and advisor, and served as an executive pastor in the Atlanta area.