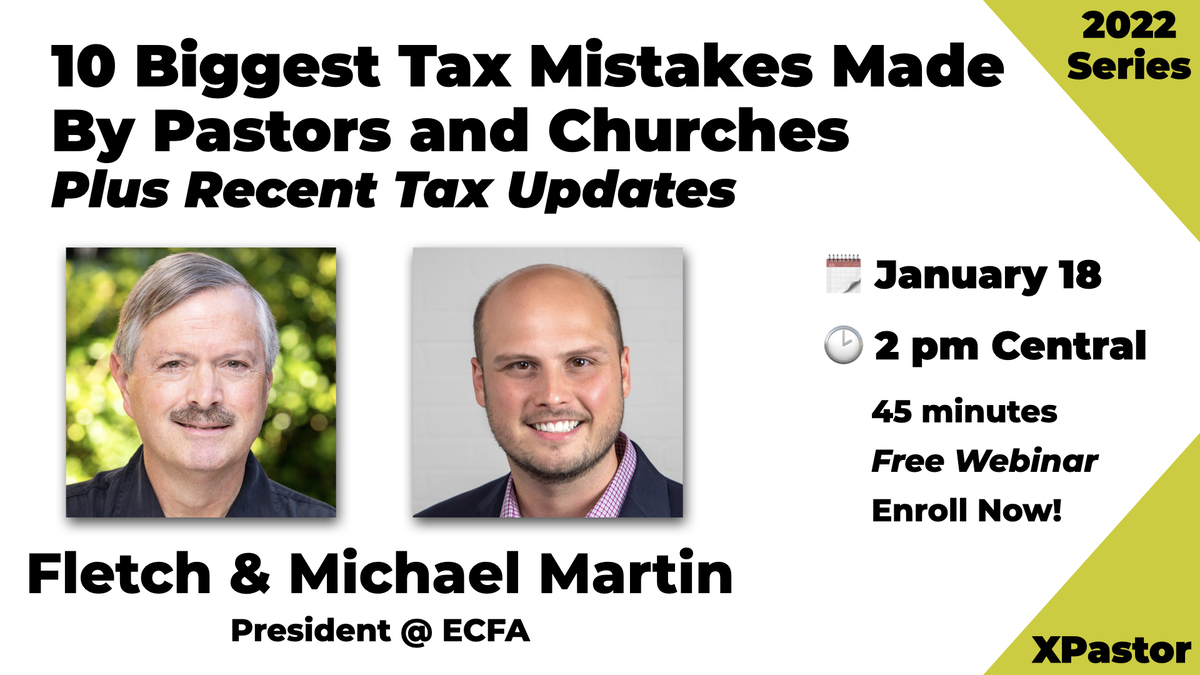

With decades of experience in publishing annual tax guides for ministers and churches, ECFA (Evangelical Council for Financial Accountability) is uniquely qualified to identify and explain the top tax mistakes made by pastors and churches in plain English. These include failure to use an accountable expense reimbursement plan and wrongly insisting that the church deduct FICA-type Social Security from ministerial compensation. In addition, we’ll explore recent developments in tax laws. For example, did you know that certain workers for religious nonprofits may now qualify for Public Service Loan Forgiveness? Are you current on COVID tax-relief measures or on the latest changes in charitable giving incentives? As you join this information-rich discussion, you can also download two ECFA 2022 tax guides for free–the Minister’s Tax and Financial Guide and Church and Nonprofit Tax and Financial Guide.

Resources

- Free download of tax guide books

Michael Martin became ECFA’s president in 2020. Both an attorney and a CPA, he had previously served on ECFA staff for nine years, most recently as Executive Vice President. Michael is passionate about helping churches and Christ-centered ministries maintain high standards of integrity and accountability through ECFA accreditation. He is a frequent speaker on ECFA’s webinars, videos, and podcasts, as well as a regular contributor to ECFA’s library of ebooks and other written publications.