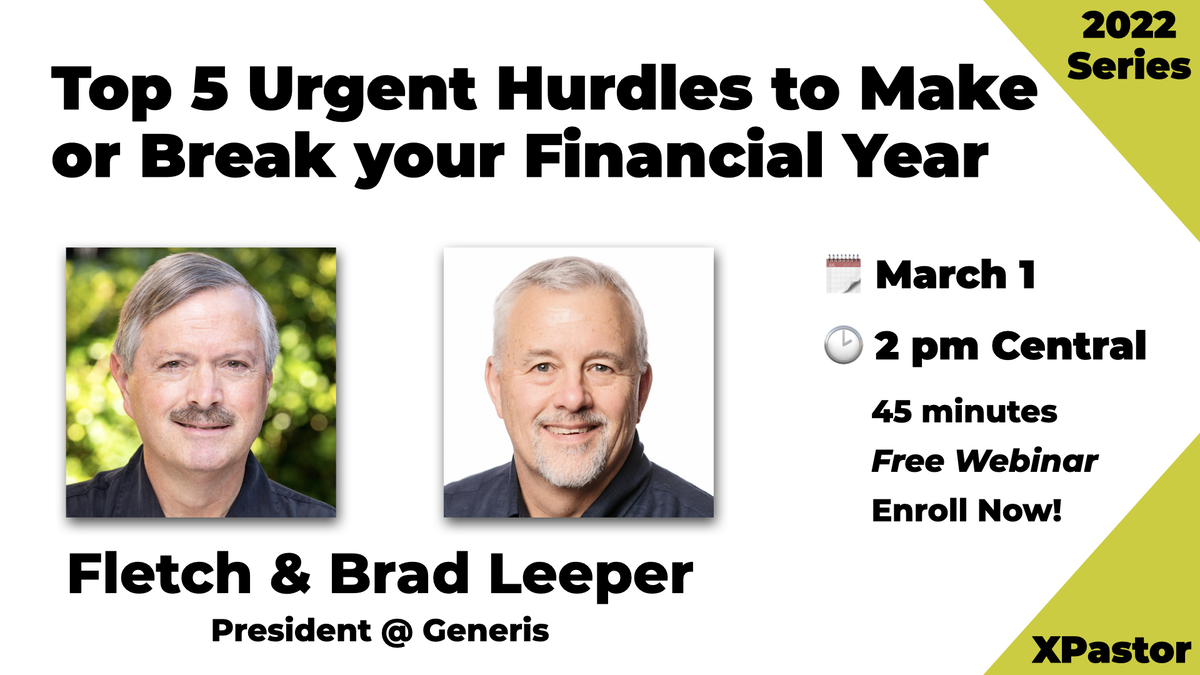

This is a sample of what Brad Leeper, President of Generis, sends to his ministry partners—churches that he helps to guide regarding their generosity. Although it is from years ago, the principles of wisdom are still intact!

Thank you for your ministry and investment into God’s Kingdom! It has been a joy for me to journey with you through the year. Because of your friendship and your client relationship with me, this material is simply an extension of the importance that I place on you and your ministry.

The potential end-of-year gift is an important element in your overall stewardship teaching and modeling for the year. Taking advantage of this natural on-ramp of giving allows you to highlight your vision, celebrate the generosity of the church, and add resources to a crucial component of your ministry.

Church leaders often make an assumption that their congregation will automatically consider the church as an option for tax-planning gifts. This assumption is not valid if the church is silent regarding the project and the need.

- A donor will assume the church does not have a need if there is no communication about a special holiday opportunity to give. If you communicate appropriately and unapologetically, the donor will tend to place the church opportunity above all of the alternatives given to them in this time of the year.

- A special project at the end of the year is one of the few moments in the life of the church to build the value of generosity. If done on a consistent, annual basis, the donor base will reserve their end-of-the-year gift for the project that they know is coming.

- Some studies suggest that up to 40% of American paychecks are now tied into some level of bonus and profit-sharing. Often, these bonus payments come in at the end of the year or in January. While considered income like a regular paycheck, there is a tendency for people to behave as if their giving or tithe from the extra income is like a bonus, too. Their giving from a bonus is often handled like free agent giving, that is perceived as different from their regular giving. The donor can think about bonus income as: “Where is a good place that I can give this money that aligns with my vision and gives me a sense of joy?” Providing an opportunity for special giving at least gives you the chance to teach about giving and to direct resources to the church mission.

- Because December 31 falls on a Monday this year, the potential for end-of-year giving is quite likely focused on gifts given either December 30 or, more likely, last minute large gifts on that Monday. People will tend to make their decisions on that last Monday, which is likely a holiday for them. Make sure that someone is in the office to receive gifts delivered in person.

- Please be aware that electronic giving is increasingly popular. End-of-year donors, particularly larger gift donors, will look for electronic options first. You have ample time to establish an online giving option for your church webpage if you do not have one already.

“What kind of projects should we consider?”

- Human touch projects are well received in the Christmas season. This kind of opportunity is consistent with the coming of Christ and the compassionate, merciful elements of the holiday season. Consider a partnership with the local food bank, AIDS hospice, or other trusted, local ministry partner. Note: Visitors to your church during the holiday season are often eager to give as an expression of their interest in the things of God. Visitors have an authentic need to give. Giving actually can be part of their spiritual journey development and, at times, an expression of a deeper level of interest in connecting with your church in a very safe manner.

- Missions giving, both local and global, is often a preferred option. The project must be specific rather than so broad as to miss the human touch. The potential donor must be able to see the project and sense a legitimate connection with the project and with their own heart. Examples include a special missionary with connections to the church or a construction project such as a school, water-well, or medical mission station.

- A special project for the church facility such as renovating the youth area. Is there an important project that was deleted from the budget planning? This opportunity might be a way to fund the need.

- Debt retirement, while not glamorous, can be a felt-need option for giving. Many believers see debt as something that should be eradicated sooner rather than later. Note: With shifting interest rates, it might not be wise to retire debt at favorable terms, especially if you foresee a need in the coming months to borrow funds again. Why pay off low interest money and pay the fees to borrow money with higher interest rates? Make sure that you will not be penalized for pre-payments or are not in a swap arrangement that can change your loan if you pay down the debt. Debt retirement is described as “Increasing ministry funds by decreasing debt.”

- Planning and development for the next construction phase can be an intriguing option. The soft costs of professional fees for planning can be higher than the budget can allow. Need to work with an architect or design-build firm for master planning? Perhaps this opportunity can fund the need. People are eager for the leadership to use due-diligence in their planning and will see the wisdom and value of planning in advance.

- A combination of the above options can be appealing, especially if a couple has different preferences in giving. One spouse might have the human touch element at their heart while the other may have a facility project at the forefront of their passion. Offering more than three projects will dilute the opportunity. Tell the church how the money will be applied, such as 50% to the local food bank and 50% to the camp in India.

“Will a special project dilute giving to the regular fund? We always have a big giving month in December?”

If communicated properly, this special project will be perceived as an over-and-above offering, not related to their regular giving. While the intent of the end-of-the-year gift is to involve the entire church, many of the larger gifts are made for tax planning purposes. Often, the tax planning gifts are allocated for projects beyond the regular giving.

Consider including language in the announcement like this:

This project is designed to be an expression of our church family’s generosity. Your regular offerings are important to the mission of the church and should not be diverted to this project. Please consider a gift above and beyond your regular giving for this project.

“Is a mass mailing a better way to communicate the project?”

No. A mailing is a one-time event that is very labor intensive. A more consistent communication process, such as the weekly bulletin, is far more effective and easier on the staff.

Consider a section on your website to communicate the project. Because most church websites are used by visitors and not regularly accessed by the members and regular attendees, a website option is a secondary, but important, reinforcement.

The samples below are designed to help you orient your congregation to the option of planning for an end-of-the-year gift.

Sample for long-range planning

Timing: Now to November 25

Purpose: Alerts people to the planning need, especially those who might give appreciated assets.

Project: At this point in the year, the project is not necessary to highlight. For this unique group of people who must plan their giving, often in conjunction with their financial professionals, the objective is to forewarn them to the option and move them toward planning their gift. It is better to plan ahead than to make a possible knee-jerk decision at 10:00 pm, December 31.

Sample Copy for use:

As we head into the close of the year, it is a good time to plan end-of-the-year giving. With the market setting an all-time high this year, this may be an opportunity for you to give appreciated assets. Many people have stock worth more than they paid for it. A gift of long-term appreciated stock offers three benefits: you avoid the capital gain tax, you receive an income tax deduction based on the current stock value instead of the cost basis, and you invest in people’s lives by giving to your church or other charitable organizations. If we can be of any service to you, please contact xxxxxxxxxxxxxxx xxxxx@xxxxxx.org or xxxxxxx, xxxxx@xxxxxx.org

Sample for inclusion in the worship bulletin

Timing: November 25 to December 30

Purpose: Tells the story of the specific project.

Project: In some detail, explain the project. Why are we funding this project? Why are we funding it now? (Answers the question: “what happens if the project is not funded?) What do you want me to do?

Options in communication

- Consider creating a special brochure (tri-fold, one or two colors is adequate) that explains the project and includes pictures. The brochure is included with the bulletin every Sunday until December 30.

- Consider a video that tells the story in pictures. If you have the capability, place the video on your website or Youtube.com for additional viewings.

- Simply describe the project in a highlighted manner in the bulletin and run the announcement in the bulletin every Sunday until December 30.

- Consider creating a special envelope for the offering. While the worth of envelopes is debated for regular giving, a special envelope can be a meaningful tool for a family in this season. A simple red envelope, coordinated with the Christmas theme, is adequate. You can print a special logo or title on the envelope reinforcing the project. It is surprising how many people will hang the envelope on the refrigerator as a reminder to make the gift during the Christmas season. You might place the church address on the envelope in case the person prefers to mail the gift if they are away during the season. Note: Place the envelope in the bulletin every Sunday through December 30.

If we include the announcement and envelope every Sunday, will the congregation react negatively?

Yes, there is a small risk to this reaction and you might shorten the time of the project communication by a week or two. However, with the Christmas season full of irregular attendance schedules and visitors who are eager to give a meaningful financial gift, including the announcement and envelopes each Sunday is a helpful aid. You will receive some gifts the first Sunday you announce the project. Most of the gifts will arrive toward the end of December. You will discard a large number of envelopes and possibly brochures, but the funds you will receive and the ease of the process for the donor will greatly surpass the discarded items.

Because of the tax laws and our desire to be honorable to the rules of giving, please include this specific detail in any announcement that you make

A reminder that financial gifts to be tax deductible in 2007, the church must receive those gifts by December 31, 2007. Your gift can be given in the regular offering, given in person at the church offices, or be mailed with a postmark on or before December 31, 2007.

The church offices will close December 31 at 5:00 pm for those wishing to bring in their gift in person. Of course, your gift in the offering Sunday, December 30, will be considered a 2007 charitable gift for tax purposes.

Please be sure to check with your accountant or other qualified tax-advisor for specific advice for your tax planning purposes.

Sample for year-end gift ideas

Timing: November 26 to December 30

Purpose: Alerts people to the various options in giving which stirs creative alternatives in their planning.

Project: The project is already communicated in the bulletin or creative vehicle. This section is designed to prompt ideas for the church family. These options can be included in the church bulletin or in a separate resource. Consider offering a link to your website in the bulletin announcement that takes people to this information.

Sample Copy for use

Many Christians are amazed at their ability to give, over and above, to God’s kingdom. Your giving is, of course, more than tax planning. Your gift and investment into eternal things makes a huge difference in the lives of many.

Here are some year-end gift ideas for you to consider

Gifts of Cash

This option is the most common way to give and to secure a 2007 charitable deduction for tax purposes. If you mail your gift to the church office, please make sure the envelope is postmarked on or before December 31, 2007. This postmark will qualify you for the 2007 giving deduction, even if we receive the gift in early January 2008.

Be aware that some employers will match charitable gifts, meaning that your gift will count even more. Check with your employer if you think this option applies to you. Some employers will not match gifts to religious organizations.

Gifts in cash are fully deductible up to 50% of your adjusted gross income, if you itemize. Any excess giving amount can generally be carried forward and deducted in succeeding years. Check with your qualified tax advisor for details about your own situation.

Gifts of Stock

With the stock market currently at record levels, a stock gift might offer you significant benefits.

Gifts of stock held more than one year offer two unique advantages:

- A gift of stock to the church avoids capital gains tax for you on the increase in the value of the stock.

- You receive a deduction for the full fair market value of the stock at the time of the gift to the church.

Again, always check with your qualified tax advisor for specifics relating to your personal situation.

It is generally not wise to sell the stock on your own and give the proceeds to the church. Selling the stock on your own means you will have to pay capital gains tax on the transaction. You pay unnecessary taxes and the church receives fewer funds for ministry.

Please contact the church office to discuss a gift of stock to the church.

Gifts of Real Estate

A residence, rental home, vacation home or raw land may offer a significant tax advantage to you. If this asset has appreciated in value through the years, giving the asset to the church will possibly reduce your tax obligation. By giving the property to the church, you would avoid the capital gains tax and receive a deduction for the full fair market value of the property.

Please check with your qualified tax advisor for the specifics regarding your specific situation.

Please note that the church has a policy regarding accepting gifts in this nature. Because the church requires due diligence in accepting all gifts, the church reserves the right to accept or decline gifts of real estate. Legal obligations and market forces can make acceptance of a real estate incompatible with the policies adopted by the church leadership. Please contact the church office to discuss the option of giving real estate.

Estate Planning

Estate planning is a wise option for the stewardship of God’s resources. Sound estate planning can save a substantial amount of tax obligations, allow you to direct your estate to the ministry that matters most to you, and provides resources to further God’s call for our mission.

Contact the church office for more information about estate planning.

End of Legislation That Allows a Tax Advantage for 2007

If you are at least 70½ years old, recent legislation allows you to give us up to $100,000 directly from your IRA without producing federal income taxes. This IRA charitable gift option concludes at the end of 2007. This tax advantage is not currently an option for any years beyond 2007.

This legislation offers another unique benefit. The amount taken from the IRA and given to a qualified charitable cause does not count as part of the individual’s charitable contributions for the year, which would typically be limited to 50% of Adjusted Gross Income. The amount can be given from a traditional IRA or from a Roth IRA. Generally, a person with $100,000 Adjusted Gross Income could only donate a maximum of $50,000 to charity. Under the provisions of this Act, that person could withdraw up to $100,000 between now and December 31, 2007, donate it to a qualified charity and it would not count against their 50%.

While this information is not intended to be an exhaustive listing of options for your 2007 tax planning, these ideas will give you options for your consideration. Contact your qualified tax advisor now to allow adequate time for your planning.

Thank you for your commitment to the Lord, to this church, to being a good steward all through the year!

Feel free to contact XXXXXXXXXXX at XXXXXXXXXX to discuss these or other options that you are considering.

Prepaying 2008 Contributions

Some members who have had a big income year in 2007 often seek to find as many deductions as possible this year. Consider giving some of your 2008 giving in 2007. Consult with your qualified tax advisor to make sure. There are some limitations on charitable giving in tax deductions.

Online Giving Options

Churches have tended to avoid placing an online giving option by credit card. Church leaders appropriately fear sending the message that debt is okay. Other leaders have concerns about losing a percentage of the gift as a fee for the credit card transaction.

Because our culture has significantly shifted its payment practices, it is currently very reasonable and shrewd to offer online giving, especially for end-of-the-year tax gifts.

How does it work for end-of-the-year tax planning?

“It’s 11:00 pm, the night of December 31, and I have to make that gift prior to midnight. I prefer to give to my church. Let’s check the website … No, not an option for the church, but this other ministry has an online payment option. It is not my first preference, but it works for me at the moment …”

A large gift given in this manner is well worth the fees—you might not have received the gift otherwise.

Yes, some larger gifts are given this way for the donor to accrue mileage or reward gifts. While we can debate the motive in giving for this benefit, it is wise of the church to make it convenient for the person to make a gift that expresses their heart and preference. If they are giving to gain mileage as a secondary benefit, they are likely to find an outlet that gives them that advantage. Why not place the church in a position to leverage the growing preferences of electronic giving?

Other benefits of online giving at your website are:

- Can ease the burden of registration and processing fees for ministry activities such as retreat registration, special events, and other options that require payment. Off-loading work from the accounting and money handling processes can easily justify the small fee incurred for the transaction. The option may actually be more cost effective for the church.

- Crisis giving is a new cultural phenomenon. 9/11, the tsunami, and earthquake disasters create an immediate need to give. People are often very eager to respond quickly rather than wait several days for their church to offer a giving option for relief. Online giving options allow the church to capture the need to give sooner rather than later in a moment of crisis. The church leadership can determine how to specifically allocate the money, but the church can offer a valid venue for giving in the moment of need.

- Your neighbors and infrequent visitors might have an impulse to give for a variety of reasons. They are likely to check your website first and might give if you give them an avenue to do so.

Options for a Gift Policy Acceptance

These guidelines will help the church develop a set of acceptance and disposition guidelines for donated gifts, especially non-cash gifts.

These guidelines are simply a tool to begin the dialog with your church leadership. These items are not intended to be an exhaustive listing of options.

- Unrestricted cash gifts will be accepted and receipted through the normal finance and accounting procedures of the church.

- Receipt of non-cash gifts will be the responsibility of the Business Office. The church reserves the right to decline and return to the donor any gift determined to be unacceptable because of value, marketability, or any other reason deemed inappropriate to the church.

- All non-cash gifts (except for real estate) will be immediately liquidated by the church. Gifts of stock, various kinds of securities, insurance products, automobiles, livestock (or other animals), jewelry and other items of value must be unencumbered and given outright to the church.

- If the gift is determined to be acceptable to the church, the gift will be immediately sold in a manner deemed most appropriate by the church.

- Gifts of real estate must be given with an appropriate title search, environmental evaluation, survey and appraisal. All costs of transferring will be born by the donor. Gifts of real estate must also be unencumbered with liens, litigation or any other potential liability to the church.

- Before title is accepted by the church, the church reserves the right to decline the gift.

- All non-cash gifts will be acknowledged in a dated letter from the church Business Office (or other appropriate person), which will include a description of the gift and copies of the appropriate IRS reporting forms.

- Questions concerning this policy should be referred to __________________.