One of the hardest experiences I have ever had as an executive pastor is coming to the reality that our church will have to lay off a staff member. The burden hurts beyond words. It makes me want to pretend that the reality isn’t true. I ask myself over and over “What mistakes have we made?” or “Is it my fault that we are in this situation?” “Am I missing something somewhere?” “Have I accidentally overlooked a place where we can cut?” “Have I done everything I can in order not to have to make this decision?” And let’s not forget, “God, seriously?” This is gut-check time. What do I truly value? How are we going to lead in this current reality?

There is so much stress, turmoil, and heartache leading up to this despairing decision. I feel like the decision just glares at me like a standoff in a western movie. The glare is intense. Who is going to draw first? Day after day, night after night, there is a continuous routine of combing through the budget, line after line, trying to find a few hundred dollars to cut so that you don’t have to totally change another person’s family life. This is the underbelly of leadership that no one wants to talk about or admit is there. It’s so painful that we don’t want to open the vault door and peer inside. No one is signing up for this workshop! It’s excruciating. It’s real. Something will have to be decided.

To make matters worse, everyone is going to feel the reality of this type of decision. Your staff knows that something has to be done. They begin to feel the weight as well. Tensions rise in the office. Patience gets depleted. Everyone continues to “red-line.” Someone is going to short-circuit. If feels like you are all in a pressure cooker. The environment is primed for some drama. It hurts to be responsible.

Once you have gone through a layoff experience and have a year or so under your belt, you know what pain is seared into your soul. “I don’t ever want to have to go through that again.” Now let’s be honest. If you are in these types of circumstances and have a staff member that you know isn’t carrying their load, then the decision arrow points in their direction. It still may not be easy to make the decision and look the person in the eyes and tell them, “We’re going to have to lay you off.” However, you know deep inside that the decision may have been coming anyways and the current circumstances have given the opportunity to move them along. I am not referring to these types of staff scenarios.

What I am talking about is when you truly love those you work with. They have become family. You work well as a team. You have longevity, trust, and loyalty established. You believe in every one of them and they are exceeding in their calling and ministry roles. They have integrity, character, and are fully capable of fulfilling their responsibilities. Your team is rockin’ on all cylinders. They are assets that you never want to lose. They are incredible. These are the kind of staff you want to keep around and help carry the load of ministry for long periods of time.

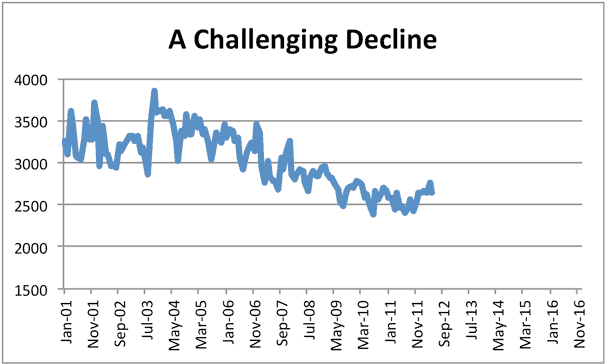

Unfortunately, financially funds are plummeting. For whatever reason, expenses are exceeding income. What do you do? Are there any other options to consider other than layoff? Do you as a church have to go there automatically? Do we even have a plan for this?

What about your staff team? Are they willing to enter into this reality together and weather the storm? Is everyone willing to sacrifice for the sake of the whole? How much sacrifice should be allowed before you say it is enough? How much is enough?

What about you? How has your church and leadership responded to the hard times of this past year’s economy? When funds are low and stress loads are high, what is your church leadership’s “mode of operation?” Has your church leadership adopted a plan to follow when hard times come? How do you lead your staff through the reality of financial change?

The reality is that there will be difficult times. Hard times are inevitable and are going to affect every church in America. Ecclesiastes 7:14 states, “Enjoy prosperity while you can, but when hard times strike, realize that both come from God. Remember that nothing is certain in this life.” I like thinking about the times of prosperity! That seems like a happy place. However, I don’t like the word “when.” This means that it is only a matter of time before hard times will come.

There is no perfect system, plan, or nugget of wisdom that will make any one of us immune to the reality of hard times. The big “but” in the passage is that times of prosperity and times of hardship are both from God. Thankfully, we learn, and God continues to teach us and give us wisdom. We use our education, experience, and the combined wisdom of many counselors to help guide us when hard times come.

I’d like to say that Vanguard Church has come up with a brilliant plan because we are so skilled, smart, or righteous. The reality is our plan has been birthed because of our pain and brokenness. What we call our Seven Step Process has been refined by our hard times and experiences. We hope we don’t have to go through this plan very often as a church. To be honest, when I hear the Seven Step Process title, memories of past pain immediately surface. It’s a sobering reality of our leadership. I get a visual flashback of that morning sitting in my office, looking into another person’s eyes and facing them with the reality that they will no longer work at Vanguard.

At other times, however, hearing the Seven Step Process title is a comfort to me. I know that no matter what emotions all of our leadership experience, we can be stabilized because we have been there before and know what to do. We may not like Step #7, but we know what we will do if we are faced with dire circumstances as a church. I hope what I share in these next paragraphs can help churches, spare some relational hurt, and equip leaders with the confidence they need to lead when they are called out into the town square and faced by the financial gun-slinger.

Step #1: Address the Body

Vanguard will inform our body and leadership so that they can be aware of the church’s financial standing and give an opportunity for the church to respond. The reality is that our leadership was already aware. In late August, 2008, we communicated from the pulpit, in our program and in our mid-week report, our (1) church’s financial situation, and (2) how much we were behind and the amount that was needed to get us back to black. Our philosophy is to make it known and give an opportunity for a response. Many of our attendees and members were already giving financially all that they could. There were several families that had already lost their jobs. We communicated that we know, as a church, that we are not immune or an exception to what everyone in our church is experiencing as it relates to our economy. We simply wanted them to know our current status and that we would be implementing the Seven Step Process. Then we prayed, waited, and watched the numbers. In the meantime, we began going down Steps 2, 3, 4, and 5.

Towards the end of September, we announced that we would have a “family meeting” on a Wednesday night in October and invited all those interested to come. The meeting informed our body of our decisions up to that point, what steps we had implemented and what was on the horizon.

Step #2: Renegotiate Leases and Loans

Vanguard will make an attempt to renegotiate any leases and loans. This is sometimes (often times) not an option, but you never know until you ask. We happen to have a very good relationship with our landlord. We have some rented office and student ministry space, in addition to the property our church owns. We looked into renegotiating our terms or temporarily changing our rent and putting some compensation on the back end of our lease. Our attempt was to provide cash flow and give our church more time to meet the needs of our current circumstances. The landlord declined.

Next we contacted our lender about our current mortgage and rates. We needed to see if we would be able to either get a better rate or go into an interest-only period of time to conserve cash flow. Our church wasn’t too far out of our transition from our construction loan. Rates had continued to fall and we had never missed a payment. Our hopes became a reality when we were able to renegotiate ¾ percentage point on both of our loans. In addition, we were able to secure a twelve-month period of time that would be interest only. Step #2 gave us some breathing room since we just moved into our new building in January 2008.

Step #3: Renegotiate the Option to Buy

Vanguard will attempt to renegotiate our “option to buy” payments. Currently Vanguard is in a position to purchase the remainder of the shopping center where our church is located. We entered into renegotiations with the landlord about our monthly payment that Vanguard was exercising in order to hold the guaranteed price to purchase the shopping center by 2012. Unfortunately, we were unable to change these circumstances unless we were willing to relinquish the money we had already paid into the fund. The price on this one was too steep at this point. We needed to implement Step #4. Through this point our church still hadn’t reached the cash flow numbers needed to breathe.

Step #4: Scale Back Ministries

Vanguard will freeze ministry spending and scale back its ministries to a previous year’s budget in order to ease monthly spending. This step really has two parts. First, the entire church goes into a spending freeze. If something needs to be purchased over $50, then the staff member or director needs to get approval from their leader. It was stringent but necessary. We want to continue to do ministry and not completely freeze everything. Our staff was on a “spend it if you need it” mode of operation.

Second, since we were in the fall and going through our budget process for the upcoming year, we decided that we would operate under our 2006 budget. This meant that when we went into January 2009, we would be using the 2006 operating budget template.

At this point in our current financial circumstances, most of our leaders were already operating with this mindset. Every little bit helps. We still had more to cut and we needed to get ahead of the cash flow snowball.

Step #5: Suspend Staff Benefits

Vanguard will suspend staff benefits such as retirement, cut professional expense, mileage, etc. with the only exception being health insurance. Our leadership decided that we should implement Step #5 at the beginning of the fourth quarter of 2008. When we entered into our October 15 family meeting, we articulated our need and communicated to our body that we had activated our action steps through Step #5. We were anticipating more income in the fourth quarter and needed to lower our expenses and try to get ahead. This action step could give us more cash flow and prepare us for the first two months of the new year that are typically not that great when it comes to income vs. expenses. We only had a small margin of error. If we exceeded that margin, someone would have to be laid off. As you can imagine, no one was happy about this one. When we as a staff experience benefit cuts, it is like the “check engine” light on the dashboard flashing. We all realized that we were running out of options.

After implementing Step #5, we were close but still needed more funds. We decided in December 2008 that for the month of January 2009, we would have to cut staff salaries and go to Step #6. Also, we decided not to fill a cleaning position that had become vacant in the middle of December.

Step #6: Implement Staff Pay Cuts

Vanguard will cut all staff salaries across every level of leadership. Depending on the deficit, Vanguard would decide what percentage of pay cut everyone on staff would experience. The standard in the past has been 10% for a month.

For us, this is one of the hardest steps. Not just because we would all lose income, but as a leader, you have to determine how much is enough and how long will you allow your entire team to suffer. At Vanguard, this is a month-to-month decision, depending on the numbers. This is our last option to try to keep everyone on staff and not lay anyone off.

We believe that every person on every level of leadership should be affected before we lay off a person. Our philosophy is that we are a family and every member has value and no one is expendable. All of us are willing to make a sacrifice to try and keep the family intact. We put our money where our mouth is.

We decided to implement Step #6 for the month of January 2009. Our staff experienced a loss of benefits in the fourth quarter of 2008 and then a 10% pay cut for the month of January. Not exactly the best momentum-gaining strategy for the beginning of the new year, but the most necessary to keep our staff together. We waited and watched the numbers.

Step #7: Layoff Staff

Vanguard will lay off staff. Vanguard will create a list of staff to be laid off and in what order. This is an incredibly painful process and brings up all kinds of emotions. You have gone through everything you know to cut and still it isn’t enough. If you are the leader having to do this, you look at salary, ministry responsibility, how can you cover in some way what will be lost, etc. If you are the non-decision maker, you want to know where you are on the list. This is a painful place to be. Thankfully, in our current situation we have not had to lay-off a person in 2009.

Vanguard’s mission is to love others into a real relationship with Jesus Christ. As a team, we believe that we have a common calling on our lives and that we are not here to simply fulfill a job description. We believe as a staff and leadership that we have to “walk” our mission and live it out. On our staff, we are attempting to have real relationships with each other and take what comes with the blessing and pain of relationships. Paul writes in 1 Corinthians 12:26, “If one part suffers, all the parts suffer with it, and if one part is honored, all the parts are glad” (NLT). We don’t just suffer together, we also celebrate together. Relationships are our foundation and the “why” we would go through each step together.

Since we are a young church plant, we have the luxury of creating our own DNA. Kelly, our senior pastor, and I have been friends for over sixteen years and have worked together for over nine years. I realize that not every church leadership has this opportunity to infuse DNA immediately and it may take years to implement change. However, I do want to say that if your senior pastor and your senior leadership will not buy into this kind of culture, it won’t happen. I believe that DNA is the hardest thing to change about an organization.

Our Seven Step Process has been used as a helpful tool to guide our elders, staff, and church body through hard financial times. It continues to serve as our outline in order to protect our family culture and we try to do whatever is necessary to keep us together. When you stand up and fight for what truly matters, you come out better on the other side—but you still have scars. I am grateful for my staff and leadership culture. Vanguard Church is a twelve-year-old church plant with about 1,300 people on a given weekend and a current operating budget of $1.5 million.

It is my genuine passion that what we are experiencing together as a church can help the body of Christ as a whole. May God bless and provide for you as you live out the calling He has placed on your life and church.