Articles on Finance

Offerings. Tithes. Stewardship. Generosity. Giving. Sacrifice. Finance. There are many words that we use to describe the money that is received by the church for ministry use. There are also many facets to the Finance Department as they aid ministries by organizing the necessary funds.

Practical Church Risk Management

In many churches, risk management can become an after-thought as the tasks and needs of day-to-day operations take center stage. But this can open the door to unnecessary risks—an avoidable accident, allegation, or other [...]

Church Financial Health, A Lender’s Perspective

Ever curious about what happens to all of the financial statements that you submit when applying for a loan? Or how church lenders view the financial health of your church when you’re looking to [...]

Estate Planning for Churches in the 21st Century

Estate Planning is an often overlooked financial tool when evaluating church funding now and in the future. National surveys tell us that over 65% of our church members don’t have any type of estate [...]

Debt, Financing, and Lending Readiness

Despite uncertainties in the financing market, your church may be in a place where you are considering financing for renovations or new building projects. We’ll discuss what many churches overlook about lending readiness and [...]

Options for Churches Seeking Audits or Other Accountability Measures

Churches desiring to employ an audit or other accountability measure with respect to their financial operations may opt for various approaches, depending on their size, scope, and complexity. Audits and other financial accountability activities [...]

Generosity: What’s Ahead in 2024

Generosity is an action. It is the ongoing activity of giving away what you can’t take with you at the end of your life. To understand it better, Brad will share about what happened [...]

Trademark & Copyright 101: Protecting your Church Brand

In this webinar, we will discuss what trademark and copyright is, the importance of filing for protection, and the trademark and copyright application process. Brianna Nevels, Associate Attorney with the firm, will also be [...]

The Employee Retention Credit—The Good, the Bad, and the Ugly

The Employee Retention Credit (“ERC”) started out as a lesser-known relief provision contained in the CARES Act passed into law at the beginning of the pandemic in March of 2020. Over the last three [...]

How to Activate Your Church Buildings for Greater Community Impact

Has your church considered ways you could use your buildings for greater community impact during the week? Join us for a look at how to do this in a financially sustainable way. We’ll discuss [...]

Data Erasure vs. Risk Management

The Clash of Privacy and Protection of Vulnerable Populations Protecting Personal Information Everyone has a story about personal information fraudulently obtained by a security breach, Phishing email scam, or sold by a vendor gathering [...]

Budgeting Effectively During Economic Uncertainty

The unknowns of the economic uncertainty we face—including a possible recession and higher interest rates—can create challenges as well as potential opportunities for church leaders as they work to develop an effective budget. Join [...]

The Path to Financial Peace at Home and Church

Finances are a crucial aspect of our daily lives. We need them to provide for our basic needs, pay our bills, and pursue our dreams. However, it can also be a source of stress [...]

7 Reasons to Offer Estate Planning at Your Church

Most church leaders don’t have a will or an estate plan. So it is easy to see why church leaders don’t encourage congregants to get one either. So many say, “I don’t have enough [...]

End-of-Year Letters Are Vital

Year-end letters are vital to the life of your people and church. They can share stories of ministry and remind people of God’s great work during the year. A number of years ago, my [...]

The Top 5 1/2 Questions XPs Are Asking about 2023 Giving Trends … with Surprising Answers

We had the pandemic and that raised lots of eyebrows about giving. Now we are in a post-pandemic era. There is angst about economic uncertainty and changes in core giving engagement. What is giving [...]

What’s a Pastor to Do When Called to Testify in Court?

Have you ever had a church member ask you to testify in court on their behalf? At some time in your ministry, you will likely receive questions from a congregant requesting your attendance and [...]

Internal Controls From 30,000 Feet

Internal controls are vital in the life of a church’s finances. But, what are they? How can they help staff, give great data and protect against fraud? Mike Lee is an experienced CPA and [...]

Faith Driven Investment Policies for Churches

Doing ministry in the twenty first century is expensive—and that was before the recent bout of inflation. Finding ways to generate increased returns on the resources the Lord has blessed and entrusted to your [...]

Anatomy of a Church IRS Examination

The IRS has just informed you of its intent to initiate an inquiry or examination of your church. What happens next? How do you navigate from here? In this webinar, we will walk you [...]

When Church is Work – 5 Trending Legal Issues for Christian Employers

Making sure Sunday, and every day, runs smoothly at church requires a dedicated team. Whether it takes 2 or 52 to staff your church, you need a solid foundation of employment practices to protect [...]

Effective Benchmarking: Thinking Outside The Box

Comparing key data points against known metrics is a tried-and-true method for assessing financial health for any organization. In this webinar, we will discuss how to answer key financial health questions in plain language—using [...]

Free: The Church Financial Field Guide from CapinCrouse

In today’s challenging environment of rapid change and transformation, church leaders must embrace new skills, ideas, and approaches to succeed. In The Church Financial Field Guide, a new e-book from CapinCrouse, Partners Stan Reiff [...]

Budgeting in Uncertain Economic Times

Churches, like all organizations, are being impacted by inflation and economic uncertainty. What will the effect be on your ministry’s revenues, expenses, and future opportunities? How can you budget effectively amid this uncertainty and [...]

Legacy Gifting: From the Why to the How

As leaders, we are called to seek out and then shine a light on the path for the faithful to follow. One of those paths is stewardship and generosity. But how do we facilitate [...]

Disposing of Church Assets: A computer, a cell phone and a 1932 Rolls Royce

Hey Fletch … We don’t have a policy for selling church property. Some staff have given furniture away, sold equipment, or sold things to family members. Do you have a recommendation on the sale [...]

Top 5 Urgent Hurdles to Make or Break Your Financial Year

A Focus on the Next 10 Months to Finish the Year Exceeding Budget Even though giving is stable now, what variables loom ahead that could disrupt your financial world to diminish your church mission? [...]

River Valley Church Receives $400,000 in Crypto Donations

Creating Catalysts of Generosity with Cryptocurrency An interview with Clynt Reddy, Executive Director of Operations for River Valley Church and Engiven. Each year River Valley hosts an annual event called Kingdom Builders, where they [...]

Ten Biggest Tax Mistakes, Part 2

In Part 1, we had so many questions from the live audiences, that we only got half way through the "10 Biggest Mistakes." Now for the second half! With decades of experience in publishing [...]

Money and Ministry: 7 Financial Mistakes You Don’t Want to Make

Many leaders are making expensive financial mistakes that limit their impact. Avoid the seven most problematic areas within your financial operations and discover a blueprint to fully resource your ministry and maximize effectiveness. Join [...]

10 Biggest Tax Mistakes Made By Pastors and Churches

With decades of experience in publishing annual tax guides for ministers and churches, ECFA (Evangelical Council for Financial Accountability) is uniquely qualified to identify and explain the top tax mistakes made by pastors and [...]

Negotiating and Managing Bank Debt

You are thinking of a loan for your new building or you might be looking to refinance a current loan. How much debt can your church prudently carry? You haven’t looked at the covenant for [...]

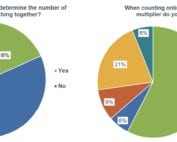

Eight Practices For Effective Online Giving

I’ve spent a lot of time on church websites recently ... like dozens of hours on hundreds of websites! Along the way, I noticed some trends about online giving. Having grown by 21% in [...]

Virtual Currency and Charitable Contribution Guidelines in Federal Tax Law

Charitable Contribution Guidelines in Federal Tax Law for Donors of Virtual Currency Valued at Greater than $5,000 Whatever you may think about virtual currencies, one reality is that a significant number of people have [...]

Designing an Effective Chart of Accounts for Churches

There are four basic principles of effective chart of accounts design and they are most prominently applied to reporting elements like travel, supplies, and meals. You can redesign your general ledger accounts to create [...]

Pastor Tax 101—Federal Tax Benefits and Rules Applicable to Ministers

Pastors and federal tax issues is always a hot topic. We all want to use the most benefits that are available ... but are we? This broadcast with Fletch and Michele will discuss the [...]

Eight Tips for Addressing Inflation Creep

How does a church make a mid-course adjustment to the vision, facility drawings, funding and timeline of a project when costs have increased significantly? Believe it or not, this is a very real scenario that [...]

The Mistake of Borrowing Money to Pay for CapX Expenses

The moment has come where your organization is facing significant Capital Expenditures (CapX), this might be a roof or HVAC replacement. But, you have not established an appropriate capital reserve fund. Your roof won’t [...]

Leadership Lessons from a Bank with a Biblically-Centered Culture

Most banks have a culture of profit. What if a bank took a biblical world view that included profit with the biblical principles of honesty, integrity, truthfulness and fairness? The bank created a document [...]

4 Essential Tools for the Future of Church Growth

We all have ideas about how our church could grow in the next month. There are a number of digital tools and systems that can help you run your church, but what’s actually working [...]

Heart Financial Planning: A Summer Check-In For Pastors

Almost every pastor I talk to gives to the church. But, the majority seem to give from duty, obligation, almost joylessly. I can almost hear some of their inner thoughts: The box is checked. [...]

Assessing Church Financial Health Made Easy

Assessing Church Financial Health Made Easy—Even if you are not financially inclined So … you’re an XP (or equivalent) and you’re in charge of (among other things) the financial health and operations of your [...]

Legacy Gifting: The Heart of Stewardship

The stewardship journey is not only the work of a faithful follower of Christ but those chosen to lead them. The church has a unique opportunity to provide leadership in encouraging the completion of [...]

Giver Expectations and Intent

It’s critical to remember that the cycle of requesting and/or receiving a charitable gift is not complete until the expectation and intent of givers have been met. Creating a realistic expectation of what will [...]

Cyber Criminals in the Church: A Whopper of a Tale

In today’s world, not even the church is immune to cyberattacks. Our ministries are vulnerable to phishing, data theft, and even extortion. The attorneys will provide examples of damage and recovery from organizations just [...]

Fraud and Cybersecurity In Your Church and Remote Workplaces

Churches are reflecting on the past year and how they adapted to the pandemic, including embracing the “new normal” of supporting operations with remote staff. While remote work can provide many benefits related to [...]

What the Church May Look Like After COVID-19

During the CapinCrouse 2021 National Church Virtual Seminar held on February 24 and 25, 2021, I had the opportunity to lead a workshop in which leaders discussed what the church may look like after [...]

The Equality Act

Hey Fletch … This week we had a leadership discussion around the Equality Act. Our senior pastor brought this topic up in an elder meeting. It raised some questions worth answering or trying to answer. Our [...]

Religious Freedom During COVID-19 and Beyond

The world has changed dramatically over the past year. In the midst of the global pandemic, ministries are caught in the crosshairs of determining how to protect their religious practices and their flock. There [...]

Giving in 2021 & How to Engage More Donors

What should you expect in projected giving through the balance of 2021? How will you engage more givers to end the year financially better than you expect? Get answers to these pressing questions. We'll [...]

Sexual Harassment in the Church

Hey Fletch … I would like to bring our staff through some type of sexual harassment training and share our sexual harassment policy. Are you aware of any videos, articles or resources that you [...]

Emerging from Covid : 8 Steps your Ministry Must Consider

Join Fletch and Chris Lewis, Senior Manager at Thrivent, for a look at the financial implications of emerging from Covid. We will look at ministry strategy, costs, cash reserves, expansion issues and more. Your [...]

Analyzing Key Financial Indicators: Debt Ratios and Measurements

In this article, you will learn: Why monitoring debt ratios and measures is important. How to analyze different debt ratios and measures to provide significant insight for your church. Recommended benchmarks for debt ratios [...]

State of Giving 2020

Full of charts and graphs, the Evangelical Council for Financial Accountability has produced a free 24-page report on the state of giving in 2020. Warren Bird Ph.D., Vice President of Research and Equipping, served as [...]

Analyzing Key Financial Indicators: Cash Flow Ratios

In this article, you will learn: Why monitoring cash flow ratios is important. How to analyze different cash flow ratios to provide significant insight for your church. Recommended benchmarks for cash flow reserves and [...]

Turning to Technology to Fill Collection Plates as Churches Remain Closed

As the pandemic continues to affect the traditional methods of engagement, it’s more important than ever to adopt digital solutions to streamline ministry management and boost donor giving The pandemic has affected almost every [...]

How to Budget Effectively in Changing Times

The current pandemic and economic circumstances create uncertainty regarding future revenues, expenses, opportunities, and challenges. This brings shifting priorities, strategies and tactics. Let’s see how to tie budgets to strategy, even in uncertain times. [...]

6 Key Considerations for Budgeting in Changing Times

There is still considerable uncertainty about the global COVID-19 pandemic and its long-term effects. What will the effect be on your ministry’s future revenues, expenses, and opportunities? How can you best manage continually shifting [...]

Anchor Your Giving If the Economy Falters

Of all the things you as an XP have to navigate and worry about, what if a downturn in financial resources this fall is added to your list? Let’s talk about how to position [...]

Federal Courts Adopt Pro-Intern Approach

Whether to pay interns or not has been a sticky subject for a long time. Do you know about the recent decisions from federal appellate courts that have adopted a more flexible, pro-internship approach? This [...]

Hone Your Online Giving & New Features

Fletch and Troy Pollock always have intriguing discussions. This time they will focus on how to hone your online giving. This will be coupled with new features in online giving. Fletch loves technology—automation that [...]

Five Reasons Your Organization May Want to Elect the 8-Week Covered Period for Its PPP Loan

The Paycheck Protection Program Flexibility Act (the “Flex Act”), which became law on June 5, 2020, replaces the 8-week period (referred to in the law as the “Covered Period”) for spending Paycheck Protection Program [...]

How Is the Church Feeling About Finances?

Join a lively discussion that tries to make sense of why evangelical churches and Christ-centered nonprofits are expressing so much optimism about their financial future. Learn who is most optimistic—and also who is most [...]

PPP Loan Good Faith Certification: Now What?

As CapinCrouse previously reported, U.S. Treasury Secretary Steven Mnuchin has announced that the Small Business Administration (SBA) will perform a “full audit” of the loan applications of all recipients of Paycheck Protection Program (PPP) loans [...]

Paycheck Protection Program (PPP) administered through the SBA 7(a) program

Cass Commercial Bank has prepared preliminary information on the Paycheck Protection Program (PPP) administered through the SBA 7(a) program. Things may change some as the program works itself out on website and lenders. Thanks [...]

Brotherhood Mutual Coronavirus Update

It is always a good idea to stay in touch with your insurance carrier in a time of crisis. Brotherhood Mutual is a sponsor of XPastor and has provided a free resource guide for [...]

When to Use Outside Experts

Churches used to be able to handle a crisis or major event on their own. The current scenario is complicated by publicity on social media, a tangle of laws and regulations and the prevalence [...]

When Embezzlement is Discovered

The Evangelical Council for Financial Accountability has a downloadable PDF detailing what to do when fraud is discovered.1 When a church discovers embezzlement within the ministry, the following issues should be considered with the assistance [...]

WheatFields’ Report Card on Risk Management

In Fletch’s book, Predators—The Case of the Church Embezzler, uses a fictional case study of WheatFields Good News Church. Executive Pastor Dan Black created a report card to evaluate how the church is doing [...]

WheatFields’ Report Card on Embezzlement

In Fletch’s book, Predators—The Case of the Church Embezzler, he uses a fictional case study of WheatFields Good News Church. Executive Pastor Dan Black created a report card to evaluate how the church is [...]

Red Flags of Embezzlement

This material is from The Evangelical Council for Financial Accountability. With its mission of Enhancing Trust, ECFA now certifies nearly 2,300 Christ-centered churches and ministries based on its high standards in financial management, governance [...]

Areas of Risk Management

We have brought together material from Mike Batts and from Brother Mutual to see the scope of risk management. Mike Batts is the managing partner of Batts Morrison Wales & Lee. He has more [...]

9 Essentials of Avoiding Fraud

Fraud is just about losing money, right? Fraud does have negative financial implications for churches, but the impact goes far beyond money. Fraud and misuse of church resources can create sensational news—and not good [...]

Utilize the Experience of Your Insurance Agent

Charlie Cutler is the Managing Partner of ChurchWest Insurance Services and works with over 3,000 churches. He offers these thoughts from the perspective of an insurance agent. As ChurchWest says, “A good agent will [...]

An Insurance Company on Child Protection

Brotherhood Mutual Insurance Company has a free, 60-page ebook, Child Protection in a Ministry Environment: Guidelines for Ministry Workers. With sample policies and forms, the major areas of the book are: Identifying Abuse: Disrupting [...]

Tools for Averting Predators—Preventing and Discovering Fraud

These tools are provided by The Evangelical Council for Financial Accountability. With its mission of Enhancing Trust, ECFA now certifies nearly 2,300 Christ-centered churches and ministries based on its high standards in financial management, [...]

How to Get the Most Out of Your Church Ratio Analysis

Effective financial ratios can give your church vital insight into your financial condition and trends. But once you’ve gathered all the data necessary to prepare a ratio analysis and complete your reports, what’s the [...]

Reflections from an Attorney on Sexual Offenders

Eventually most churches encounter a known registered sex offender who is either already in the congregation or desires to attend. Trying to determine whether or how to live with a wolf is dangerous and fraught [...]

Preventing Sexual Abuse in Your Church

Sex abuse claims remain the top reason churches go to court each year. Fletch interviews Matthew Branaugh, editor for Christianity Today’s ChurchLawAndTax.com, about this troubling ongoing trend in the church. What policies and protocols [...]

Top 10 Reasons Church Loans are Declined

Join Fletch and leaders from Thrivent for an insider’s look into church loans. Both Chris Lewis and Teresa Loker have extensive experience that can pull back the curtain on these issues. When your church is [...]

5 Building Blocks of Church Financial Integrity … with free ebook

Michael Martin and Fletch examine a vital topic of how to ensure your church has financial integrity. When you have a problem in this area, your donors get nervous and may stop giving. From his [...]

Digital Giving Trends

Fletch and Troy Pollock began an intriguing discussion at the 2019 XP-Seminar. Back by popular demand, this "state of digital giving" continues that discussion. From his vantage point of working with thousands of churches around [...]

Successful Church Project Planning

Getting a church loan is an area that most church leaders find murky and complicated. Chris Lewis from Thrivent has expertise from his years of helping churches with their borrowing capacity. The video ranges from [...]

First Person Report on an Internal Control Audit

This article is by a student in XPastor's Course MS-203, XP Boot Camp. To preserve confidentiality, the author will be listed as anonymous. One of the assignments for those taking the class for certification was: Take [...]

Borrowing Designated (Restricted) Gift Balances

Tuesday, May 14, 2019 Hey Fletch … Our finances have trended downward and we borrowed $20,000 from the unused balances of restricted funds. This caused some controversy on the church board. What is your counsel? [...]

Numbers Based on Operating Budget or Total Revenue

Hey Fletch … Do you have benchmark data that documents total compensation as a percent of total revenue (restricted and unrestricted), not just of the operating budget? I know over the years I have seen [...]

Seven Common Mistakes Churches Make When Performing a Ratio Analysis

Church board members are eager to fulfill their fiduciary responsibility and watch over the long-term economic health of the church. However, most are not used to reading nonprofit financial statements. This can make it [...]

How Can We Do a ‘Love Offering’

Hey Fletch … We occasionally receive love offerings for our senior pastor and other staff members. How should we handle these gifts? DRF—There are so many questions floating out there about restricted gifts to churches. [...]

Building Campaign that Falls Short

Hey Fletch … Two years ago we launched a building campaign for our church, but we fell short of our goals. Now the board has decided not to expand the building, but rather to use [...]

Supporting Missions Work

Wednesday, April 3, 2019 Hey Fletch … Our church provides direct support to several international missionaries. What are the issues we should look at to provide this support with the utmost integrity? DRF—There are so [...]

Mileage Reimbursements

Hey Fletch … Some of my fellow XPs have a variety of polices regarding mileage reimbursement for staff. I am wondering about best practices regarding this issue. Any help? DRF—Check the current IRS mileage reimbursement rate [...]

Giving to a Short-Term Missions Team

Monday, March 25, 2019 Fletch is back from his research break, writing Predators in the Church Hey Fletch … I’ve been tracking with Dan Busby’s comments in the Hey Fletch column. I know gifts [...]

ASU 2016-14 and Churches: Four Key Questions Church Financial Leaders Should Ask to Understand the New Liquidity Disclosures

Recent nonprofit financial reporting standards updates will result in several changes to external financial statements that church financial leaders should understand. Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-14 is intended to [...]

Gifts for a Needy Person

Tuesday, February 26, 2019 Hey Fletch… We have a widow in our church that is going through serious medical challenges. She has exhausted her financial resources. Several wealthy members of the congregation want to [...]

Can a Church Pay FICA for a Pastor?

Hey Fletch … It’s been one month after I got your answer to my question. I still don’t have my head wrapped around this issue of FICA vs. SECA and how it relates to Housing [...]

Staff Budgets Are Cut

Hey Fletch … I’m been on staff at our megachurch for many years. Every year, I have to worry about the budget for my area being cut in the middle of the year, sometimes twice [...]

Supreme Court Decision Continues for Nonprofits That Sell Items

As we originally reported in our June 21, 2018 Special Alert℠, the U.S. Supreme Court recently ruled in South Dakota v. Wayfair, Inc., et al., that states can, in some circumstances, require a seller [...]

Mileage Reimbursement for Missionaries

Wednesday, February 13, 2019 Hey Fletch! First off, thank you so much for bringing such an informative and fun workshop to Hawaii. It was such a pleasure to see you and we look forward to [...]

Giving Envelopes and Designated Giving

Tuesday, February 12, 2019 Hey Fletch…our church envelopes and website allow donors to make designations. There are words that say, “The board has complete discretion and control over the use of all donated funds.” Can [...]

Obligations with Donor Designations?

Tuesday, January 29, 2019 Hey Fletch … What are our obligations in handling donor designations? These come either verbally during a church service, on our website, or by text. They can also be formally given [...]

Benevolence: The Right Help Given the Right Way

Churches are in the charity business. They are commanded by God to help the poor, the sick and the wounded. But the church also must abide by tax rules designed to prevent abuse. This [...]

Donor Designated Gifts

Tuesday, January 15, 2019 Hey Fletch … I heard that if a donor designates a gift made to our church, we cannot provide the donor with a receipt under the theory that designated gifts are [...]

Pay for a Wedding

Friday, January 11, 2019 Hey Fletch … If a pastor performs a funeral or wedding and is paid directly, the pastor gives the check to our church finance office. I then add it to their [...]

Running a Church

Tuesday, January 8, 2019 Hey Fletch … I’ve been reading the columns for a while. It seems like you know so much about churches. I would say that ‘Fletch knows how to run a [...]

New Year Help on Taxes

Monday, January 7, 2019 Hey Fletch … I heard you say at the Smart Money workshop, "If a pastor has low housing costs, it can actually hurt them financially." My question is how? Isn't it [...]

Tax on a Church Parking Lot?

Saturday, January 5, 2019 Hey Fletch … Do I need to pay unrelated business income tax on my parking lot? I heard a lot of noise about this last fall but what was the final [...]

Policies on Appropriate Spending

Friday, January 4, 2019 Hey Fletch … Do you have any policies or procedures which outline appropriate spending? Our SP has a credit card but we haven’t ever put limits on spending. We are [...]

Four Levels of Givers

Friday, December 14, 2018 Hey Fletch … I was at the Smart Money for Church Salaries workshop in Dallas. It was awesome. I’m creating an executive summary of my notes for our directional team [...]

Renting Church Rooms to the School District

Wednesday, December 12, 2018 Hey Fletch … We are in an unusual place. Many times new churches rent or lease space from public school systems. Our county school system is seeking to lease classroom space from us [...]

Please Support Me

Thursday, December 6, 2018 Hey Fletch … I am senior pastor in Kenya. We face financial problems in our small church. A salary for me is just a dream. We kindly request if any assistance. [...]

Tax on Church Parking Spaces

Wednesday, December 5, 2018 Hey Fletch … Anything on your radar regarding 2018 tax law that is calling for non-profit organizations to file a 990-T for tax on parking spaces provided for employees? Our [...]

Did I Break the Law in Opting Out of Social Security?

Friday, November 30, 2018 Hey Fletch … When I first became a pastor, people advised me to opt out of Social Security. I had been in business for over 20 years and they said, “you [...]

Use of Movies and Trademarked Images in Church

Hey Fletch … This may not be in your wheelhouse but I know you have a lot of experience and knowledge! We are doing Christmas at the Movies this year. When it comes to [...]

Are Discounts to Church Events Taxable Income?

Saturday, November 24, 2018 Hey Fletch … We are thinking of offering all staff who work 32 hours a week or more discounts to church retreats and functions for which there is a charge. My [...]

Donations for Funeral Expenses

Friday, November 23, 2018 Hey Fletch … I have a question related to a special donation. A family in our church had a very unexpected death in their family. Another family in the church would [...]

Attorney Needed for Pastor Who Opted Out of Social Security

Monday, November 19, 2018 Hey Fletch … A few months ago we discussed our pastor’s lack of retirement planning. You mentioned you could recommend a non-profit attorney for a consultation. One of my “strategies” is [...]

Automatic Rollover of Housing Allowances

Hey Fletch … At the Smart Money for Church Salaries workshop, you referenced some language you used on the housing allowance form. This allows the amounts to roll over year after year without a [...]

Outsourcing Financials Roles

Tuesday, November 13, 2018 Hey Fletch … We are considering outsourcing our financial roles. Any insight on this? Pros / Cons? DRF—I answered a related question on August 29, 2018 in “Would We Save Money [...]

Receipts for Purchases Are So Late, Part 2

Friday, November 2, 2018 Hey Fletch … I read the question about receipts being turned in to the church within sixty days of the expense. We also have a staff member who is turning in [...]

Attorney’s Perspective on Designated Funds

Thursday, November 1, 2018 Hey Fletch … I’ve been reading about designated funds and I’m still confused. Do you have a tax expert or attorney who can also comment on the issue? DRF—We have done [...]

New Tax Court Case Says “Gifts” to Pastor Are Taxable

In a recently issued Tax Court case, Judge Mark Holmes rendered a decision that may be the most thorough judicial analysis of the law surrounding “love gifts” for pastors that has ever been published. [...]

Mandatory Sexual Harassment Prevention Training Update

California has recently updated the requirements for sexual harassment prevention training. Your state may have similar regulations. The bottom line---train all staff. Tiffany Henning at HR Ministry Solutions, XPastor's go-to resource for HR information, [...]

Qualitative Liquidity and Availability Disclosure Considerations for Churches in ASU 2016-14, Part 2 of 2

Among the many nonprofit financial reporting standards changes in Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-14, one of particular importance to churches is the new liquidity and availability disclosure. The ASU [...]

Liquidity and Availability Disclosure Considerations for Churches in ASU 2016-14, Part 1 of 2

All churches that issue external financial statements (complete with footnote disclosures) for fiscal years beginning after December 15, 2017 (calendar year 2018 and fiscal years ending in 2019) are subject to the new nonprofit [...]

Poll of Church Health Insurance Benefits

Monday, October 22, 2018 Hey Fletch … I promised to send you the results of our poll of 18 churches. Here is the file with what we found. What do you glean from the findings? [...]

Renting Office Space to a Marriage Counselor

Tuesday, October 16, 2018 Hey Fletch … A licensed professional marriage counselor who attends our church wants to rent a room so he can see clients in a location that is on the opposite side [...]

Receipts for Purchases Are So, So Late

Wednesday, October 3, 2018 Hey Fletch … Our church staff can purchase items from their own funds and then be reimbursed. This happens a lot with youth trips and out-of-town ministry. We have a [...]

More on Designated Funds

Monday, October 1, 2018 Hey Fletch … Thanks for your answer to my designated funds question. Let me submit another question. Someone brought an article today with the ideas of “restricted” and “designated” funds. The [...]

Special Offering for a Woman with Cancer

Thursday, September 20, 2018 Hey Fletch … Our church wants to take up a special offering for a woman who has cancer. Can we ask people to give money through the church for her? [...]

What Are Designated Funds?

Thursday, September 13, 2018 Hey Fletch … Can you educate me about “preferred ministry” rather than “designated” funds which are restricted. We are a church of 165 and struggling to make budget. As a [...]

Can an Auto Allowance Be Tax-Free?

Wednesday, September 12, 2018 Hey Fletch … I believe I'm clear on the minister's housing allowance designation. What about a car allowance? We have a new employee who says ministers can claim a car allowance [...]

Health Insurance Going Up 123%

Tuesday, September 11, 2018 Hey Fletch … I am looking for some advice on health insurance for my team. We provide a high deductible plan for our employees and have contributed a percentage of the [...]

How Your Ministry Can Help Prevent Child Abuse Through a Safety System

In past months, scores of allegations of child sexual abuse have come to light, many for the first time. On the heels of these revelations, churches and ministries have begun to better understand that [...]

Sexual Abuse Risk and Record Retention

Every child-serving organization is responsible for the protection of children in its care. To discharge that responsibility, the organization should take reasonable steps to create an effective safety system that prevents child sexual abuse. [...]

Financial Health in a Church of 100

Saturday, September 1, 2018 Hey Fletch … I am involved with trying to get our church’s financial situation back on track and healthy again. Would any of your reports contain information on a church that [...]

Ministerial Housing Allowance

Friday, August 31, 2018 Hey Fletch … I am a full time associate pastor and am applying for an apartment that is part of the SMART Housing program, a kind of government assisted, affordable housing [...]

What about Online Giving Options?

Monday, August 27, 2018 Hey Fletch … We are looking at beginning to allow online giving. We are looking at three different providers: pushpay.com, gyve.io and tithe.ly. We are evaluating each platform and like what [...]

What Should I Look for in Online Giving?

Monday, August 20, 2018 Hey Fletch … Our church is considering starting online giving. What are the kinds of things that we should be looking for? DRF—From a user’s perspective, the number one thing for [...]

Health Cost-Sharing Ministries

Tuesday, July 31, 2018 Hey Fletch … I have a question about rising medical costs for employers. There are several Christian-based health cost-sharing ministries, such as MediShare, Christian Healthcare Ministries, and Samaritan Ministries. On [...]

Scam Artist Wants Refund of Donation

Wednesday, July 18, 2018 Hey Fletch … Have you heard about this scam? According to police in Troy, Michigan, a church received a $4,500 donation for hurricane victims. Later that day, police say the [...]

Church Musicians: Employees or Independent Contractors?

Are the musicians your church pays to perform for worship services and other church events employees or independent contractors? Contrary to what some churches may believe, whether a musician paid by a church to [...]

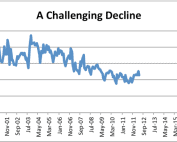

Understanding “The Big Shift”

Do you remember the E.F. Hutton advertisement? The essence of the ad is two people are talking about investments. One says, “My broker is E.F. Hutton and he says …” At that point everyone [...]

What to Do with an 85% Decline in Church Attendance?

Friday, July 13, 2018 Hey Dr. Fletch … Hi! My church of 2,000 members has dwindled from over 2,000 members to barely 300. What should I do? DRF—Thanks for your note. There must be lots [...]

Tax on Outside Groups Using Our Facility

Saturday, July 7, 2018 Hey Fletch … We charge outside groups to use our facility. Some are concerned at our church that we should be paying tax on this income. They want us to not [...]

Limited Funds

Monday, July 2, 2018 Hey David … You told me that doing this church plant was going to be a challenge. And you were so right. Our funds are so limited. I can barely afford [...]

Capital Campaign = Spiritual Revival. Seriously?

Can a capital campaign in a church cause a spiritual revival? Absolutely! I know from first-hand experience. When I was 25 years old and went through my first capital campaign, it transformed my life, [...]

Should Your Church Change Its Fiscal Year-End?

If your church uses a calendar year-end of December 31 as its fiscal year-end, you may want to consider changing it. A fiscal year-end such as May 31, June 30, July 31, August 31, [...]

Insurance for Sexual Abuse, Part 2

Saturday, June 16, 2018 Hey Fletch … Our church has $2 million in umbrella insurance. Does that cover sexual abuse as well? DRF—When I get a question on insurance issues, I always turn to [...]

Insurance for Sexual Abuse, Part 1

Friday, June 15, 2018 Hey Fletch … Our church has $2 million in umbrella insurance. Does that cover sexual abuse as well? DRF—When I get a question on insurance issues, I always turn to the [...]

Percentages of Budget by Ministry Area

Monday, June 11, 2018 Hey Doc … You answered my question regarding the average percentage of General Fund that is allocated towards Creative Arts. Are there rough percentages of General Fund expenses for Youth, [...]

Giving Away 50% of Church Income

Thursday, June 7, 2018 Hey Fletch … In all of the church connections you have, do you know of other churches that are attempting to give away large percentages (50%+) of what they receive [...]

Legal Issues with Songs on a Church Website

Wednesday, June 6, 2018 Hey Fletch … We live-stream our worship service and also have some recorded worship songs on our website. Someone asked me if that is legal. Thoughts? DRF—That is a huge [...]

Mrs. Gold and the $300,000 Check

Tuesday, June 5, 2018 Hey Fletch … On Sunday, Mrs. Gold (that’s really her name) handed me an unmarked envelope with a letter in it. When I got back to my office and opened [...]

Weekly Financial Reporting Spreadsheet

Friday, June 1, 2018 Hey Fletch … Would you mind sharing an example of a Weekly Financial Reporting spreadsheet? I'd love to see it and incorporate it. DRF— A weekly financial reporting spreadsheet should [...]

Sharing Stories of Ministry

Saturday, May 26, 2018 Hey Fletch … I like your suggestion about getting people's stories. How do you do that in a church? DRF—One of the best way to measure the effectiveness of your [...]

Weekly Report Spreadsheet for Church Income

A weekly financial reporting spreadsheet should contain a church's actual income and the budget forecast. The following numbers are from WheatFields Good News Church. This is a compiled case study church, as no church [...]

Boss Stole My Idea

Thursday, May 17, 2018 Hey Fletch … my boss stole my idea and said it was his. What gives? DRF—That’s a hard one to hear. I’m so sorry that you had this experience. Can [...]

Church Accounting Software

Friday, May 11, 2018 Hey Fletch … Thank you for putting together another successful XP-Seminar. I enjoyed it once again and look forward to it each year! I was wondering if you had any [...]

Thanks for XPastor

Wednesday, May 2, 2018 Hey Fletch … Seriously—this is an invaluable resource. Love that you are doing so much writing. I like the “Hey Fletch” column. Thanks for featuring the 14 years of XP-Seminar [...]

The XPastor Site is Different

Monday, April 23, 2018 Hey Fletch … I’ve been in ministry a long time. Your XP-Seminar is unlike anything that I have attended before. I absolutely love it. The XPastor site exudes something different [...]

Is a Donation ‘Thank You’ Too Pushy?

Thursday, April 19, 2018 Hey Fletch … Do you encourage churches to acknowledge first time givers through a thank you letter? I am considering starting this because I see this as a significant opportunity [...]

General Fund Robbed by Disaster Donations

Wednesday, April 18, 2018 Hey Fletch … I have been a fan of your work and website for several years. I have a question and would love your insight. As a board member, let [...]

Few Cheerleaders for Ministry

Monday, April 16, 2018 Hey Fletch … Thanks for the encouragement. As you might expect, working with the church does not come with a cheerleading squad. The more we work with churches in the [...]

Is Deficit Budgeting an Act of Faith?

Saturday, April 14, 2018 Hey Fletch … Our church is barely keeping the payroll and bills paid and we enter the budget process in June. Our elders keep casting a vision that requires 10% [...]

Percentage of Overall Budget for Worship

Saturday, April 7, 2018 Hey Fletch … I doubt you remember me but I was part of a group in 2011. I am currently an XP of Operations. I serve under two Co-Lead Pastors...two [...]

Electronic Waivers and Signatures

Church events are the lifeblood of any congregation’s community. From youth camp to volunteer activities to childcare, parents love having kids enjoy the events their church hosts every week. But not a week goes [...]

Online Donations Confusing for a Church School

Thursday, March 22, 2018 Hey Fletch … Our school is owned by our church. They are the umbrella. All online donations are being completed through the church. For example, if I want to donate [...]

Pastor & Assistant Falsifying Timecards

Wednesday, March 21, 2018 Hey Fletch … A pastor here at the church allows his assistant to work overtime and then they don’t put it on the assistant’s timecard. I have warned both of [...]

Ultimate Tax Avoidance?

Monday, March 19, 2018 Hey Fletch … Someone who is a supposed tax expert emailed me the following letter in response to a question: “If you buy everything you need or want in the [...]

Stolen W-2s: Follow-up

Friday, March 16, 2018 Hey Fletch … There was a column on January 14, 2018 that all of a church’s W2s vanished. Some insurance policies have coverage for this and the church may have [...]

Church Without a Tax-Exempt Status

Friday, March 2, 2018 Hey Fletch … I just began as the pastor of a rural midwestern church with 150 in worship. We do not have a tax exempt status. We pay tax on [...]

Weekly Financial Reporting

February 5, 2018 Hey Fletch … I’m working my way through the Finance 1 course on XPastor. There was a spreadsheet in class 5 on “offerings received” with an accompanying analysis of current week [...]

New Donor Email is a Mess

February 4, 2018 Hey Doc … Our new giver email is a mess. I clicked on a link and got a 404—page not found. The fonts are all strange for people who get it. [...]

Recording Songs in the Worship Service

February 1, 2018 Hey Fletch … Someone suggested that we record some songs during our worship service and create a CD from them. Any thoughts on this? DRF—Off the top of my head, I [...]

Church Finance 101

January 23, 2018 Hey Fletch … I’m looking over this PDF that you taught at Dallas Seminary on Church Finance 101. Could you send me the full copy of this topic? DRF—For several years, [...]

Stolen W2 Statements for All Staff

January 14, 2018 Hey David … A shipping firm claimed they left the W-2s for all of our employees at the church’s front door. No signature was required and they left the package at [...]

Audit and Review Infographic

When was your last church audit? What process do you use for both your internal and external audits? Regular audits help your church identify strengths, weaknesses, opportunities and threats. A proper audit schedule also [...]

New Book Helps Nonprofit Boards Improve and Streamline Financial Oversight

Mike Batts is one of our workshop leaders at the 2018 XP-Seminar. He is a noted leader in the nonprofit and church financial arena and author of five books. Mike has just released his [...]

Free 2017 Year-End Giving Guide from Generis

Givers have certain universal expectations. They expect to be listened to, treated with respect, and never taken for granted. When you ask people to give financially, you must understand that it's not something they’re [...]

Church Insurance Infographic

One of the most important decisions an Executive Pastor will make for his church is insurance coverage. Do you know what to look for when shopping for an insurance policy for your church? Are you [...]

Purposeful Budgeting Infographic

Virtually every church sets a budget. Is your budget aligned with your purpose and vision? Who can help you best define and set your budget? Kirk Morgan created this infographic using his class notes from [...]

Internal Controls Infographic

What are internal controls? How do you begin to implement ICs? Kirk Morgan created this infographic using his class notes from two of XPastor’s Online Courses--Operations 103 (Finances, Part 1) & Operations 104 (Finances, Part [...]

Generosity: Fletch talks with Brad Leeper

In these three videos, Fletch and Brad Leeper (President of Generis) talk about generosity in the church. As they answer questions posed by Executive Pastors, many illustrations will be shared regarding how churches have [...]

What I Learned from a Certified Fraud Examiner

We’ve all seen the tragic headlines about churches becoming the victims of fraud. To borrow some real-life examples: “Father and Son Pastors Plead Guilty to Stealing $3.1M from Church,” “Nebraska Archdiocese Sues Nun Accused of [...]

MinistrySafe Institute Teaches about Sexual Abuse

Receive training to help your church avoid sexual abuse. In 1997, a watershed lawsuit---the Rudy Kos Case---resulted in a $119 million verdict against the Catholic church for child sexual abuse. Twenty years later, much of Christendom [...]

When Generosity Floods—The Bayou Story

Are you ready for a flood? Are you praying for a flood? Are you anticipating a flood? A flood can be devastating, transformative, or a combination of both. Imagine waking up one Sunday morning to [...]

The Offering Moment—A Free Resource

Our friends at Generis have created a great resource called The Offering Moment. They say, "The church has a unique moment, 52 times per year, to engage with their givers in a real and [...]

Generosity, Part 1

David Fletcher and Brad Leeper began a video dialogue regarding giving, money, leadership, culture and many other important topics that fall on the shoulders of the Executive Pastor in a church. In Part One of [...]

Annual Giving Statements: Ideas from Generis

Our friends at Generis are offering their Annual Giving Statement Guide to the XPastor Community. This is an excellent resource! As a leader, you have much to do. Not only are you responsible for the [...]

Free Magazine on Generosity from unSeminary

Rich Birch will be our featured guest in two years at the 2018 XP-Seminar. He leads a great work called unSeminary. The latest edition of unSeminary magazine centers on Generosity. It gives "practical help [...]

Copier Leasing and Negotiation Tips

As an attorney, the vast majority of business and church executives I talk to dread their copier lease expiring as they must deal with leasing new ones. Recently, we helped a church with a multiple [...]

Should Your Church Consider a Cell Tower Lease?

A sales rep stops by your church office with a simple offer. Your building is ideally suited to be a cell phone tower. The equipment will be practically invisible. If you lease the space to [...]

Understanding and Engaging Your Givers

Our friends at Generis are again offering a great and free resource to the XPastor community. Their new e-book is entitled "Understanding and Engaging Your Givers." They describe the book: "Count on it: your [...]

Six Givers Jesus Knew

Sharing stories of people doing both good and great things inspires others. When it comes to giving, people can often feel shame and inadequacy. However, the Bible reveals great nuggets from people who lived attainable [...]

Use Technology to Keep Staff Safe and Cash Secure

How do you deliver ministry funds, like Sunday’s offerings, to your bank? A priest in Chicago learned the hard way that making a weekly trip to the bank is a risk that’s not worth taking. According [...]

Negotiating a Loan and Saving $17,000 Per Month

It isn’t very often that you get to save $17,000 per month for your church. I was able to do just that by refinancing my church’s debt while maintaining a strong local relationship with a [...]

How to Get Ready for a Financial Audit

The number of Americans calling themselves Christians has dropped sharply in recent years, according to a new Pew Research Center survey---while the population of religiously unaffiliated adults is on the rise. This trend is driven [...]

Expanding Abuse Reporting Requirements

Am I a mandatory reporter? If an adult describes having been abused as a child, am I required to report? When? How do reporting requirements impact individuals providing spiritual guidance? Around the country, state legislatures are [...]

How to Grow Ministry with Less Money

Recently I had the privilege of having David Fletcher talk with us on a NavXP webinar, “How to Grow Ministry with Less Money." He shared his wisdom, struggles, and stories of how vision clarity has been the guiding [...]

Contagious Generosity

I recently read the book, Contagious Generosity: Creating a Culture of Giving in Your Church by Chris Willard and Jim Sheppard. I found this book to be inspiring and refreshing; it resonated with me [...]

Budget Process Analysis

For a homework assignment in the XPastor Online Course, Operations 103—Finance, I chose to compare the budget process of First Assembly in Winston-Salem, Lakeside Church in Greensboro, Georgia, Berean Bible Church in Greene, New York [...]