All churches that issue external financial statements (complete with footnote disclosures) for fiscal years beginning after December 15, 2017 (calendar year 2018 and fiscal years ending in 2019) are subject to the new nonprofit financial reporting requirements in Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-14.

This ASU is intended to improve information in nonprofit financial statements and notes about financial performance, cash flows, liquidity, and availability. An external financial statement is a financial statement provided to outside parties or those not related to the church, such as a bank. External financial statements must include “footnote disclosures”—certain information that explains policies, background details, facts, or additional numerical summaries about totals in the statements. Unlike a typical footnote located at the bottom of a page, financial statement footnotes are placed immediately after the financial statements to provide external users with more explanation and a better understanding of the church’s financial statements.

We’ve received a number of questions from church clients about the additional disclosures related to liquidity and availability. This is an important consideration. For example, these disclosures could have an immediate implication for any church that gives its external financial statements to an outside lender for an upcoming loan application or renewal. The lender could believe that the church has fewer available funds for future loan payments than it actually has.

Let’s take a look at the requirements and what your church should consider as you plan for this significant implementation.

Reporting Operating Reserves

ASU 2016-14 requires certain quantitative information on either the face of the statement of financial position or in the notes to the financial statements. It also requires additional qualitative information about the availability of a church’s financial assets at the Statement of Financial Position date to meet cash needs for general expenditures within one year of that date.

The availability of a financial asset may be affected by:

- Its nature (financial assets not convertible to cash within the next 12 months)

- External limits imposed by donors, grantors, laws, and contracts with others

- Internal limits imposed by governing board decisions (board-designated net assets)

Many churches maintain adequate financial assets to fund their external limits. In this situation, the biggest factor impacting many churches may be board-designated net assets—specifically “operating reserves.”

While not every church sets aside operating reserves, many do. As a best practice, these churches put away reserve funds for operations and capital needs and formally approve them as “board-designated funds.” These amounts are reported as a designated portion of net assets without donor restrictions on the Statement of Financial Position (or disclosed in the footnotes).

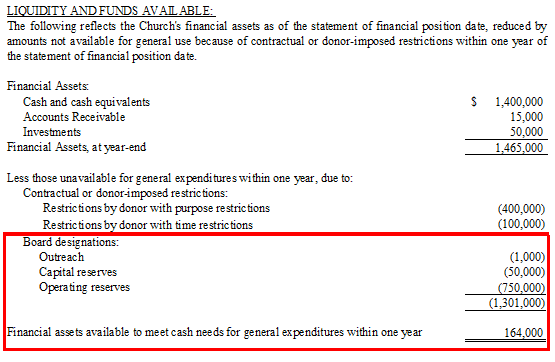

However, the ASU requires these net asset operating reserves, and all board-designated reserves, to be deducted in the quantitative information disclosure. See Figure 1 for an example.

Figure 1

As you can see, the ending total in this example is reduced by board designations, even though the church worked to build these designated reserves. This is because the ASU deducts these reserves representing amounts set aside for unexpected expenditures or shortfalls.

Clarifying the Deduction

If the amount of financial assets available to meet cash needs is perceived as an amount that is less than desired because of your board designations, you may choose to explain this deduction in the qualitative section of the disclosure. But there’s a risk that some readers—including your board members, bankers, and foundations—won’t read the disclosure. And if they do, they may not fully understand it. For example, a lender may incorrectly conclude that you have fewer liquid reserves than you do, which might cause it to make a different decision on a financing renewal or terms of a loan. Or another outside party, such as a watchdog agency like Guidestar, may conclude that your church does not carry enough liquid reserves and is worse off financially than you really are. So what can you do to clarify this?

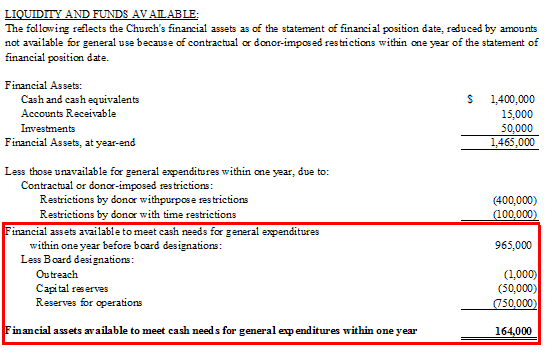

One possibility is to insert a subtotal for “Financial assets available to meet cash needs for general expenditures within one year prior to board designated operating reserves.” Below this subtotal would be a deduction of the “Board designated operating reserves” to get to the required total of “Financial assets available to meet cash needs for general expenditures within one year.” See Figure 2 for an example.

Figure 2

The qualitative paragraph could then refer to the subtotal line to make it easier for the reader to understand your church’s financial position.

Realistically, some readers of your external financial statements (potentially including watchdog agencies) may only look at or use the bottom line total because they assume it’s the best number to use for a true comparison. The irony is that a church that exercises a best practice of building operating reserves and is disciplined in setting up and maintaining board-designated net assets could be misunderstood.

Reconciling Liquidity with Net Assets Without Donor Restrictions

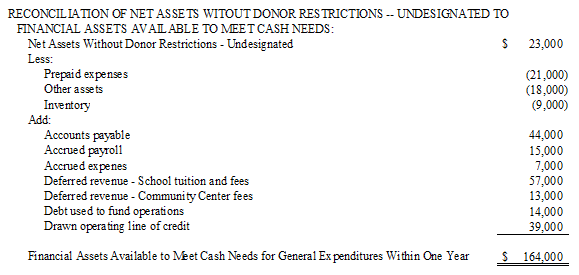

Many of our church clients also have questions about how this new liquidity amount reconciles with the net assets without donor restrictions undesignated amount (after net assets not invested in property and equipment are taken out). Figure 3 shows an example of this.

Figure 3

This reconciliation highlights several areas your church can manage or use near your fiscal year-end for this new footnote:

- Prepaid expenses—Consider making payments after year-end if an invoice is not due before then.

- Accounts payable—Consider making payments after year-end if an invoice is not due before then.

- Deferred revenues—Determine the best time to send out billings in order to receive advance receipts of cash. These advance receipts are not current revenue but would be reported as revenue next fiscal year and deferred revenue at the year-end date.

- Debt used to fund operations—It’s typically better to use an operating line of credit unless your church needs a longer period of time to fund and pay off this type of debt.

- Drawn operating line of credit—We see many churches using this cash flow strategy. Some churches have no intention of using this line, but they can then disclose it in the qualitative paragraph to explain how the church intends to manage liquidity needs in the short-term.

- Deferred capital expenditures—You may want to defer making certain capital expenditures or incurring certain deferred maintenance expenses (if using operating funds) until the next fiscal year.

It’s important to note that your church should not use the new disclosure amount to measure operating reserves. One tool that can be very useful to management and the board in monitoring these reserves is the CapinCrouse Church Financial Health Index™, an online dashboard with key measures, ratios, benchmarks, and peer information. Many churches use this tool with their church boards to monitor cash reserve levels.

Here are a few additional points to consider:

- If your annual budget increases, you may need to consider increasing the total amount of designated reserves accordingly.

- Your church cannot designate funds unless you have adequate cash and general investments available to designate.

- ASU 2016-14 does not require comparative disclosures in the year of adoption so for this year, it’s a single-year disclosure in the year of adoption.

If your church hasn’t considered how the liquidity disclosures will look in the footnotes, do it soon so you have time to consider these factors before the end of the fiscal year. This is especially important for churches with a December 31, 2018, fiscal year-end.