Peter Haas knew he had a financial challenge on his hands when he got a report on the giving patterns of his fast-growing Substance Church in Fridley, Minnesota, and discovered that his 8-year-old daughter was one of the top givers in the church.

“She out-gave a third of our congregation for the year,” says Peter, noting the relatively young and largely unchurched demographic that makes up Substance’s membership base. “I have friends at Southern megachurches who seem to draw people who were born tithing. We don’t get those people.”

The economy’s ongoing limps and struggles are taking their toll even on growing churches, but Peter Haas and others are finding creative ways to address the challenge.

Setting and Voicing a Personal Example

Short of deploying his generous 8-year-old to teach giving principles, Peter Haas’ leadership team has embraced the challenge of teaching generosity “in a life-giving way” to its largely unchurched audience.

“People are so over-sensitive about money, it’s hard to talk about it,” Peter says. “I don’t think I ever remember teaching about giving and generosity without getting a mean letter. So it’s easy to get insecure about talking about it.”

But since Peter and his wife, Carolyn, have always attempted to give away upwards of 50% of their income, and he leads his staff to live simply and generously by example, it made the topic much easier to address.

“When people hear that you live like that and you challenge them, you’re able to say ‘Dude, we’re only talking about 10%—seriously,’” Peter says. Half of our staff drives cruddy cars, we have very modest houses. It’s a different way of living that gives you permission to speak boldly about money.”

Peter says Substance Church also addresses the financial needs of a younger generation—what he calls “the most financially undertrained group of people ever”—by continuously advocating financial management small groups and classes that utilize Dave Ramsey’s Financial Peace University material. Every time leaders focus on generosity, giving to the church increases by 25%, Peter adds.

“We think sound financial principles are so fundamental to everything in your life,” Peter says. “So we are constantly trying to get people into these groups so they understand basic stewardship principles, living modestly and living smart. It’s only going to strengthen the financial base.”

Using a “Triple Bottom Line” to Raise More Funds

In Michigan, where some communities have been hit the hardest by unemployment, Senior Pastor David McDonald is challenged with how to advance at Westwinds Community Church, in Jackson, Michigan.

Westwinds, an innovative congregation that has even drawn the attention of Time Magazine because of its use of media and technology, is battling financial realities that have shrunk the town’s population from 100,000 to 30,000, cut household income from mid-$40,000 to high $20,000, and cut the church’s offerings from $1.4 million in 2004 to $800,000 in 2011—even though attendance has not changed during that time.

“Our town is shrinking, so numerical growth is a challenge and so are finances,” David says. Despite growth in new believers, David adds, “It’s hard to feel like the church is succeeding when we’re only marginally bigger or more financially secure than just a few years ago. This era of tough finances has put our creativity and innovation to the test.”

Leaders at David McDonald’s church have had to sharpen their pencils by transitioning to fewer full-time and more part-time staff members, reducing staff benefits such as conferences, meals and travel, and “spending the same money more than once”—something Westwinds calls the “triple bottom line.”

David explains that while the church still gives to global ministry opportunities, Westwinds has trimmed its giving to local missions to $1,000 per quarter for each of the church’s various ministries. But each ministry is using a “triple” approach to raise at least $1,000 more each time.

Two quick examples of how it works: The church tries to support a local charity that pays tutors for children with educational challenges. One of the church’s ministries wrote a children’s book about taking the Gospel to Atlantis, rented out a movie theater for the evening and told the story live. More than 500 people attended (most of them unchurched), and the money from ticket sales went back to the charity for tutors.

The church also gave $1,000 to a charitable organization of local artists for an art show, with an agreement to split proceeds 50:50. The church then used its part of the proceeds to underwrite summer camp scholarships for kids—scholarships that had previously been cancelled due to budget constraints.

Westwinds leaders also utilize a concept they call “targeted micro-financing,” where they match church members with particular ministry passions within the church, and ask them to give extra for that area.

“Nine times out of ten they give beyond what they’ve given before,” David says. “So all our staff have money conversations. People sell their passion to those who are likewise passionate about it. We’ve been able to do a lot more with a lot less every year.”

Using a Consultant to Improve Current Financial Practices

Ian Stamps, who leads Cornerstone Christian Church in Shiloh, Illinois, reports that his church grew 18% in 2011, with financial growth of only 7%. “Not a good gap,” Ian says, though he understands the gap is mostly because of the large percentage of previously unchurched, new believers in the mix.

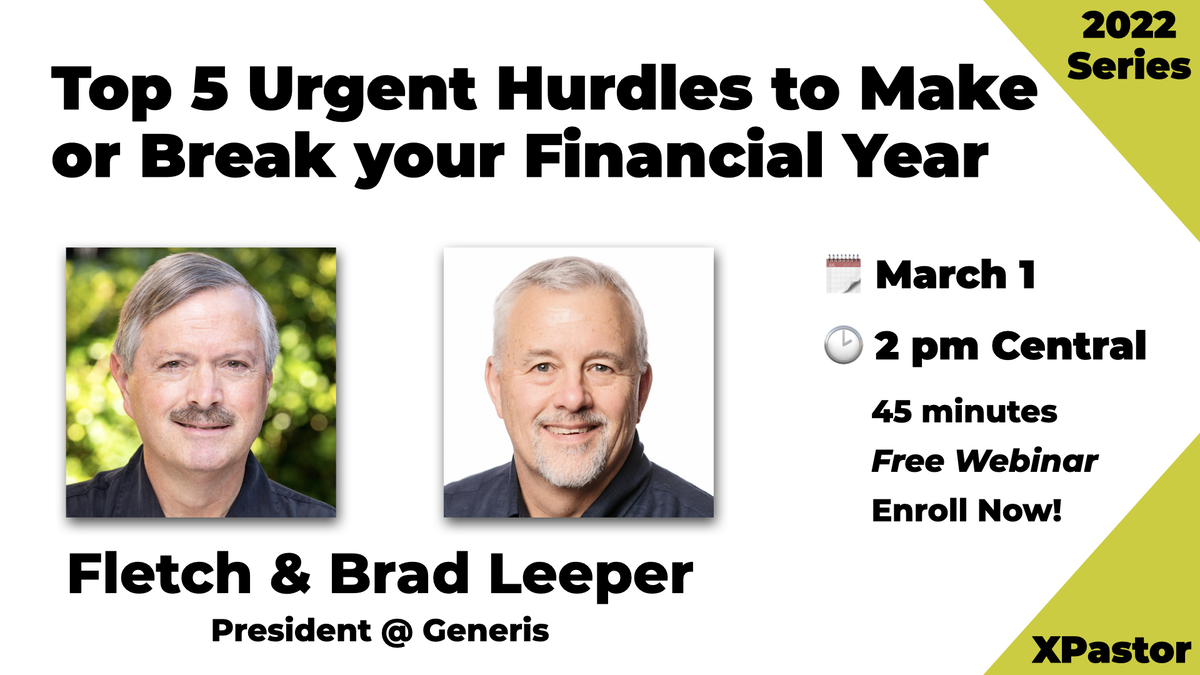

Cornerstone’s leaders implemented some of the advice and programs of church finance consultants Generis, and saw a dramatic increase in financial giving, along with record commitments for 2012. “We even ended up increasing our budget by 20%,” Ian says. Generis came in and did what they refer to as a “generosity audit.” Essentially, they review all the financial documents, interview different groups within the church to assess their thoughts on how finances are handled, as well as evaluate current ministry practices. In the generosity audit, Generis probed into Cornerstone’s ministry practices and found that they were doing announcements during offering time. “We had never really thought about the issue before but apparently that is a bad practice,” said Ian. “So we treated offering as a time of worship, as we would with communion or preaching and we also now do a weekly one to two minute introduction to talk about why we give.”

Generis also led Cornerstone through a campaign called “Will You Grow?” which calls for the church to make commitments to a general fund giving in the following year. The premise is that a person begins with where they are giving now and commits to move at least 1% larger in their giving. That adds up quickly and significantly.

Through personal modeling, creative investing, and outside coaching, church leaders are finding ways to move forward, even with the challenges of today’s economy and the congregation’s new spiritual disciplines like tithing.

Thanks to Leadership Network for this article.